How Many Times Can You Remortgage Your House? Rules and Real Limits in Canada

Nov, 10 2025

Nov, 10 2025

You can remortgage your house as many times as you want - but that doesn’t mean you should. Banks don’t set a legal cap on how often you can switch mortgages. Yet every time you do, you’re playing with your finances, your credit score, and your long-term home equity. In Canada, lenders care less about how many times you’ve remortgaged and more about whether you still qualify - and whether it actually makes sense.

There’s No Official Limit - But Lenders Have Rules

No law in Canada says you can only remortgage twice, or three times, or once every five years. The Canada Mortgage and Housing Corporation (CMHC) doesn’t track how many times you’ve switched. Your lender doesn’t either - at least not as a hard rule. What they do track is your income, your debt, your credit score, and the value of your home.

Think of it like this: every time you remortgage, you’re asking a lender to re-evaluate you as a borrower. They’ll check your employment history, your current debts, your payment record, and how much equity you’ve built. If you’ve had three remortgages in five years and your income dropped or your credit score slipped, they’ll say no - not because you’ve done it too many times, but because you no longer meet their risk standards.

What Happens When You Remortgage?

Remortgaging means you’re replacing your existing mortgage with a new one - usually to get a better rate, pull out cash, or change the term. Here’s what you’re signing up for each time:

- Appraisal fees (around $300-$500 in Ontario)

- Legal fees (typically $1,200-$2,000)

- Prepayment penalties if you’re breaking a fixed-rate term early

- CMHC insurance fees (if your loan-to-value is over 80%)

- Administrative costs from your new lender

For a $500,000 home, these costs can add up to $4,000-$6,000 per remortgage. If you do it every two years, you’re spending $20,000 in fees over a decade - money that could’ve stayed in your home equity or your savings account.

Why People Remortgage - And When It Makes Sense

Most people don’t remortgage just because they can. They do it for one of four reasons:

- To get a lower interest rate - If your current rate is 6.5% and you can lock in 4.5%, you save thousands over the life of the loan.

- To access home equity - You’ve paid down your mortgage and your home value rose. Now you want cash for renovations, a business, or debt consolidation.

- To change the term - Switching from a 5-year fixed to a 3-year variable, or extending your amortization to lower monthly payments.

- To consolidate high-interest debt - Rolling credit card balances or personal loans into your mortgage at a lower rate.

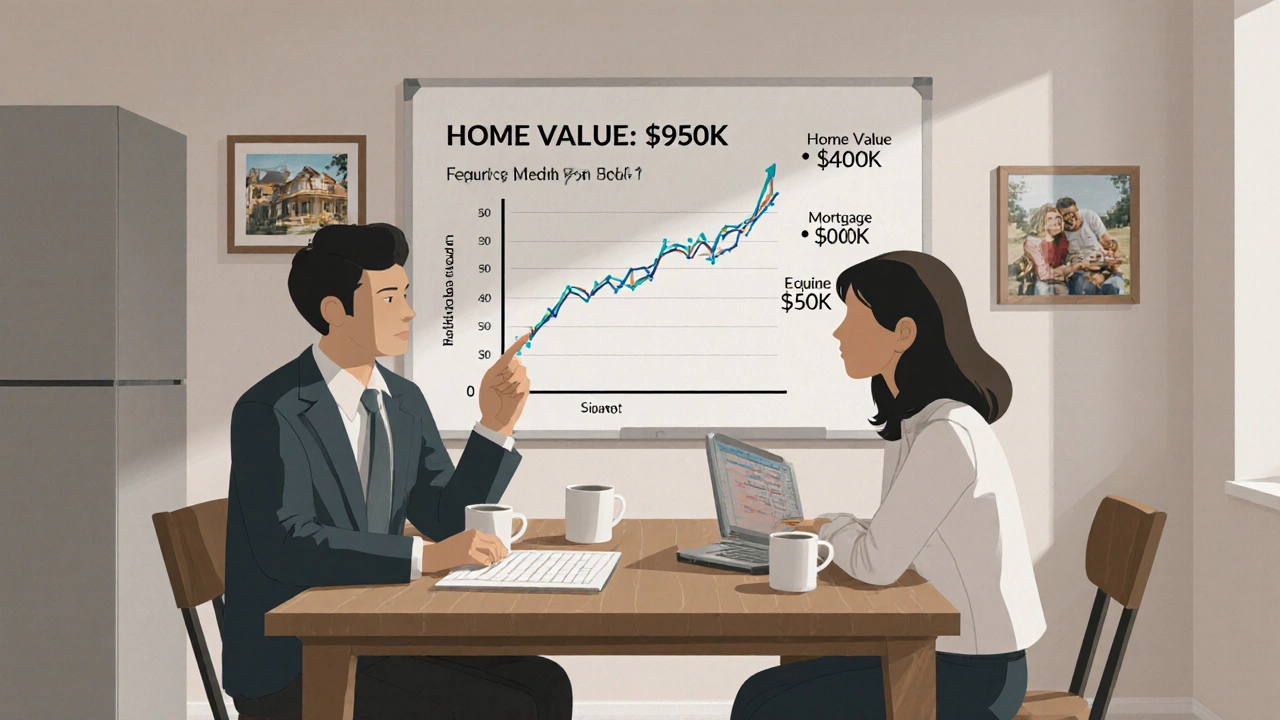

Let’s say you bought a home in Toronto for $700,000 in 2020 with a 20% down payment. Today, it’s worth $950,000. You’ve paid down $80,000 of your mortgage. That means you have $320,000 in equity. You could remortgage to pull out $150,000 for a kitchen renovation - and if you do it right, that renovation could boost your home’s value even more.

But if you’re pulling out equity just to fund a vacation or pay for a new car? That’s not smart. You’re turning low-interest, long-term debt into a risky gamble on your biggest asset.

How Often Is Too Often?

There’s no magic number. But here’s what lenders and financial advisors see in practice:

- Once every 3-5 years - This is the sweet spot. Enough time to build equity, benefit from rate drops, and cover fees.

- Twice in 3 years - Possible, but you’ll need strong income, excellent credit (760+), and a clear reason (like a major life change).

- More than twice in 3 years - Raises red flags. Lenders will ask: Why are you constantly switching? Are you in financial trouble? Are you using equity as a cash machine?

One client in Mississauga remortgaged four times between 2021 and 2024. Each time, she pulled out cash to pay off credit cards. Her credit score stayed high, but her debt-to-income ratio kept climbing. In 2025, a new lender denied her because her monthly obligations were now 52% of her income - above the 44% threshold most Canadian lenders allow.

Your Credit Score Takes a Hit - Every Time

Every time you apply for a new mortgage, the lender runs a hard credit check. That knocks 5-10 points off your score. It’s not a big deal if you do it once every few years. But if you apply for three new mortgages in 18 months, your score could drop 30-40 points.

That matters because:

- Your rate might jump from 4.2% to 4.8% because your score dipped

- You might get declined outright if your score falls below 680

- CMHC insurance premiums go up if your score is below 700

And once your score drops, it takes 6-12 months to recover - time you could’ve spent saving or paying down debt.

Prepayment Penalties Can Kill Your Savings

If you’re locked into a fixed-rate mortgage, breaking it early to remortgage can cost you big. Lenders use either:

- Three months’ interest - Common for variable-rate mortgages

- Interest Rate Differential (IRD) - Used for fixed rates. This is where the real penalty hides.

Here’s a real example: You have a 5-year fixed mortgage at 5.25%. Two years in, you want to switch to a 3.75% rate. Your lender calculates the IRD based on the difference between your rate and their current 3-year rate (say, 3.5%). For a $400,000 balance, that penalty could be $12,000. You’d need to save over $300 a month just to break even - and that’s assuming rates stay low.

Always ask your lender for a penalty estimate before you start the remortgage process. Many brokers will do this for free.

Equity Is Your Currency - Don’t Waste It

Every remortgage you do changes how much equity you have. You start with equity when you buy. You build it by paying down your mortgage and as your home appreciates. Every time you pull cash out, you’re giving that equity back to the bank.

Let’s say your home is worth $800,000 and you owe $300,000. Your equity is $500,000 (62.5%). You remortgage and pull out $100,000. Now you owe $400,000. Your equity drops to $400,000 (50%). You’ve lost 20% of your ownership stake.

Do that twice more? You’re down to 30% equity. If home prices drop 10%, you could owe more than your home is worth. That’s called being underwater - and it makes selling or refinancing nearly impossible.

When Remortgaging Is a Bad Idea

Even if you qualify, here are times you should walk away:

- You’re using it to pay off credit cards - and you haven’t fixed your spending habits

- Your job is unstable or you’re nearing retirement

- You’ve already pulled out over 60% of your equity

- You’re remortgaging just because your friend did it

- You’re paying more in fees than you’ll save in interest over the next 3 years

One woman in Hamilton remortgaged twice in two years to fund her daughter’s wedding and a new SUV. She didn’t track her spending. By 2025, her monthly payments were $3,800 - and she was 10 years away from retirement. She had no savings. She had to delay retirement by five years.

Alternatives to Remortgaging

Before you remortgage, ask: Is there another way?

- Home equity line of credit (HELOC) - Lets you borrow against equity without refinancing. Lower fees, flexible payments.

- Personal loan - Better for smaller amounts ($10,000-$35,000). Fixed term, no risk to your home.

- Debt consolidation loan - Combines high-interest debts into one lower-rate loan without touching your mortgage.

- Wait and save - If you need cash, build a side income or cut expenses for a year instead of borrowing against your home.

HELOCs are popular in Canada because they’re cheaper and don’t trigger prepayment penalties. But they’re still secured by your home - so if you can’t pay, you risk foreclosure.

Bottom Line: It’s Not About How Many Times - It’s About Why

You can remortgage five times. You can remortgage once. The number doesn’t matter. What matters is:

- Are you building wealth - or just moving money around?

- Are you lowering your costs - or just paying more in fees?

- Are you protecting your future - or trading it for short-term comfort?

Remortgaging isn’t a game. It’s a financial tool. Use it to improve your situation, not to delay hard choices. If you’re doing it for the right reasons - and you’ve done the math - then go ahead. If you’re doing it because you’re stressed, confused, or pressured - stop. Talk to a fee-only financial advisor first.

Can you remortgage your house more than once in a year?

Yes, you can remortgage more than once in a year - but it’s rarely a good idea. Each time you apply, you pay fees, your credit score takes a small hit, and you risk triggering prepayment penalties. Most lenders will approve it if you qualify financially, but doing it multiple times in a year raises red flags. If you’re doing it to chase lower rates, make sure your savings will cover the costs within 12-18 months.

Do you need a good credit score to remortgage?

Yes. Most Canadian lenders require a minimum credit score of 680 for conventional mortgages. For CMHC-insured mortgages, 600 is the absolute minimum, but you’ll pay higher insurance fees. To get the best rates, aim for 760 or higher. If your score is below 680, you may still qualify through alternative lenders - but expect higher rates and stricter terms.

Can you remortgage with bad credit?

You can, but it’s harder and more expensive. Bad credit (below 600) means you’ll need to work with private lenders or B-lenders. These lenders charge higher interest rates - often 7%-12% - and require larger down payments or more equity. They may also demand proof of stable income and a clear plan to improve your credit. Avoid these unless you have no other option and a solid strategy to rebuild your credit within 1-2 years.

How much equity do you need to remortgage?

You need at least 20% equity to avoid CMHC insurance fees. That means you owe no more than 80% of your home’s value. For example, if your home is worth $600,000, you can borrow up to $480,000 without insurance. If you want to pull out cash, you’ll need even more equity - ideally 30%-40% - to leave room for safety and future borrowing.

Is remortgaging worth it if you’re close to retirement?

Usually not. Remortgaging resets your amortization period, which means you’ll be paying until later in life - possibly into retirement. If you’re within 10 years of retirement, extending your mortgage could mean your fixed income has to cover higher housing costs. Instead, consider downsizing, using a reverse mortgage (equity release), or tapping into savings. Your home should be a source of security, not a source of new debt.

What to Do Next

If you’re thinking about remortgaging:

- Check your current mortgage balance and home value - use a free online tool like Zoocasa or Realtor.ca.

- Calculate your equity: Home value minus what you owe.

- Run the numbers: Use a remortgage calculator to compare your current payments with what you’d pay after switching.

- Ask your lender for a prepayment penalty estimate.

- Get quotes from at least three lenders - including your current one.

- Ask yourself: Will this make my life better in five years - or just easier today?

Remortgaging can be powerful. But it’s not a shortcut. It’s a commitment - and one that should be made with your eyes wide open.