Does 0% APR mean no interest? What car dealers won’t tell you

Nov, 15 2025

Nov, 15 2025

When you see a sign that says 0% APR on a new car, it’s easy to think you’ve hit the jackpot. No interest? Free money? That’s what most people assume. But here’s the truth: 0% APR doesn’t always mean zero cost. It means no interest if you meet every single condition the lender sets-and most people don’t.

What 0% APR actually means

APR stands for Annual Percentage Rate. It’s the total cost of borrowing, including interest and fees, expressed as a yearly rate. So when a dealer says 0% APR, they’re saying you won’t pay extra for borrowing the money over the term of the loan. That sounds great-until you read the fine print.

Here’s how it works: You finance a $30,000 car at 0% APR over 60 months. Your monthly payment is $500. No interest added. Sounds perfect. But that deal only exists because the dealer is offering it as a promotion. They’re not giving you a discount on the car. They’re just letting you pay the full price over time without interest.

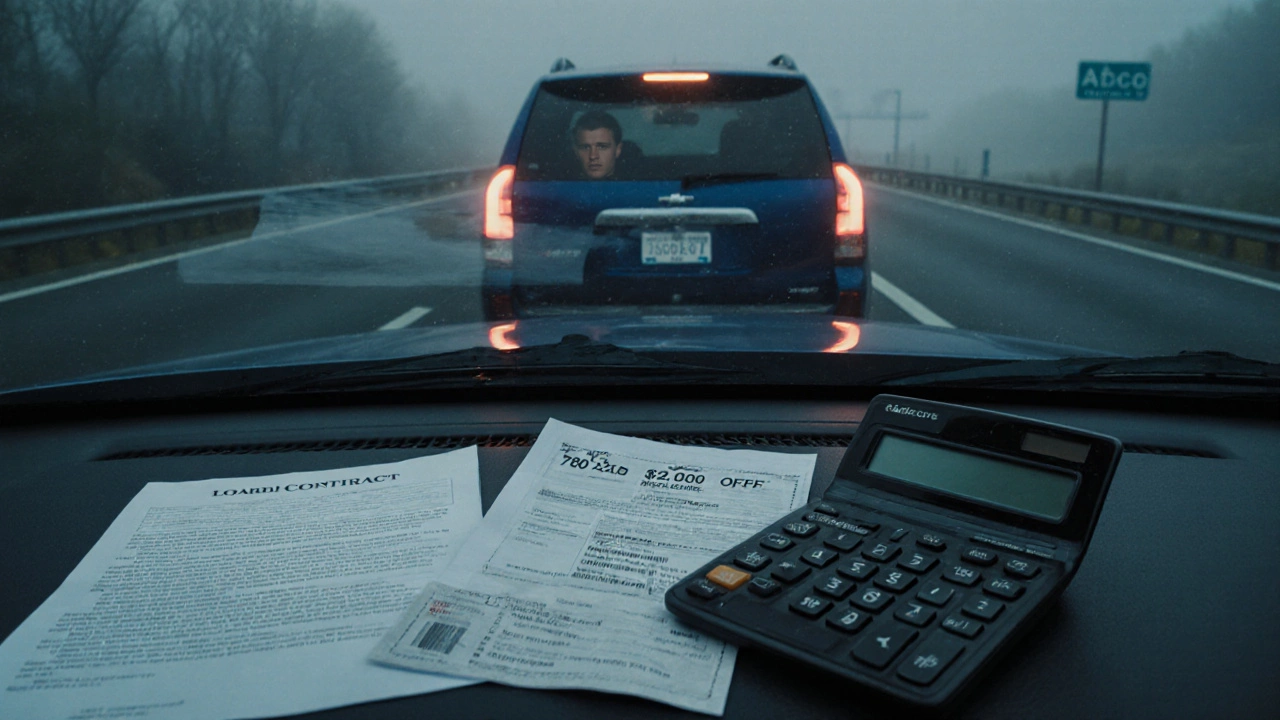

Compare that to a 5% APR loan on the same car. The monthly payment might be $566. That’s $66 more per month. But here’s the catch: if you negotiate the price down $2,000 and take the 5% loan, your monthly payment drops to $516. You’re paying more in interest, but less overall. That’s why smart buyers don’t just chase 0% APR-they check the final price first.

The hidden conditions behind 0% APR

Not everyone qualifies for 0% APR. Dealers don’t advertise this, but it’s reserved for buyers with top-tier credit. In Canada, that usually means a credit score above 760. If your score is 700, you might be offered 3.9% instead. If it’s 650, you might not get approved at all.

There are other traps too:

- Shorter loan terms: 0% deals often come with 36-month terms. That means higher monthly payments. If you can’t afford $800/month, you’ll be pushed into a longer, higher-interest loan.

- No rebates: If you take 0% APR, you usually can’t also get a $3,000 cash rebate. You have to pick one. That rebate could save you more than the interest you’d pay.

- Early payoff penalties: Some lenders charge fees if you pay off the loan early. That defeats the purpose of saving on interest.

- Only on specific models: The 0% deal is often only for base models with no options. Upgrade to leather seats or a sunroof, and the rate jumps to 5% or more.

In 2024, a study by the Canadian Automobile Association found that 62% of buyers who thought they were getting a free loan ended up paying more overall because they didn’t negotiate the price or misunderstood the terms.

Why dealers push 0% APR so hard

Dealers love 0% APR because it makes the car look cheap. A $35,000 car with $0 down and $500/month sounds affordable. But if you took that same car and paid $32,000 with a 4% loan, your payment would be $590. Still affordable. And you’d own a better car.

The real goal? Get you in the door with the promise of no interest, then upsell you on extended warranties, gap insurance, paint protection, and premium packages. The 0% APR is the bait. The add-ons are the profit.

One Toronto buyer I spoke with took a 0% deal on a Honda Civic because the salesperson said, "This is the best offer of the year." He didn’t realize the same model, with a $2,500 rebate and 3.9% financing, would have saved him $1,800 over five years. He paid $2,500 extra for the car, thinking he was saving money.

How to actually save money with 0% APR

If you qualify and you want to use 0% APR, here’s how to make it work for you:

- Get your credit report first. Check for errors. Pay down credit card balances. A higher score gives you leverage.

- Negotiate the price like you’re paying cash. Don’t let the dealer talk you into the sticker price. Use Kelley Blue Book or Canadian Black Book to know the fair market value.

- Ask for the rebate OR the 0% APR. Don’t accept both. If the rebate is bigger than the interest you’d pay, take the cash.

- Get pre-approved elsewhere. Go to your bank or credit union. If they offer 3.5%, you can use that to negotiate. Dealers will often match or beat it.

- Read the contract. Look for hidden fees, early payoff penalties, and required insurance. If it says "must finance through dealer," walk away.

One rule of thumb: If the monthly payment feels too good to be true, it probably is. A $400/month payment on a $35,000 car? That’s a 84-month loan. That’s seven years. You’ll owe more than the car is worth for most of that time. That’s called being upside down-and it’s dangerous if you get into an accident or need to sell.

What to do if you’re not approved for 0% APR

Most people aren’t. That’s okay. You don’t need 0% to get a good deal.

Here’s what works better:

- Buy a certified pre-owned car. You’ll save 15-25% off new prices, and most come with 7-year/160,000 km warranties.

- Use a credit union. They often offer lower rates than banks or dealers.

- Put down 20% or more. That reduces your loan amount and your monthly payment.

- Keep the term under 60 months. Longer loans mean more interest and more risk.

In Ontario, the average new car loan in 2025 is $42,000 at 6.2% over 72 months. That’s $712/month. But buyers who took 4.5% loans on used cars paid $510/month-and kept $8,000 in their pocket from the lower price.

The bottom line

0% APR isn’t a gift. It’s a marketing tool. It looks like free money, but it’s designed to make you pay more for the car and buy things you don’t need.

If you have excellent credit and you’re buying a car you can afford, 0% APR can save you money. But if you’re tempted by the low payment and don’t check the price, the rebate, or the loan terms-you’re not saving. You’re being sold.

The smartest move? Compare the total cost. Add up the price of the car, the interest you’ll pay, and the fees. Then compare that to the cash price minus any rebate. The lowest total is the real deal-not the one with the lowest monthly payment.

Don’t fall for the illusion. 0% APR isn’t magic. It’s math. And if you do the math right, you’ll walk away with a better car and more money in your pocket.

Does 0% APR really mean no interest at all?

Yes, but only if you meet all the conditions: you must have excellent credit, accept the exact model and trim level offered, stick to the loan term, and not take any cash rebates. If you miss any of these, you’ll pay interest or end up paying more overall.

Is 0% APR better than a cash rebate?

It depends on the numbers. A $3,000 rebate on a $35,000 car with 4% interest saves you more than 0% APR on the full price. Always calculate the total cost: (car price - rebate) + (total interest paid). The lower total wins.

Can I negotiate the price if I take 0% APR?

Yes, you should. Many dealers expect it. Don’t let them say "this is the best deal" and stop negotiating. The 0% APR is just one part of the deal. The price of the car is the biggest factor in your total cost.

Why do dealers offer 0% APR if they’re not making money?

They make money elsewhere. The manufacturer often pays the dealer a bonus to move certain models. The dealer makes up the lost interest by selling add-ons like extended warranties, maintenance packages, and higher-margin accessories. They also make more profit on customers who can’t qualify for 0% and end up with higher-rate loans.

What’s the catch with long-term 0% APR loans?

Longer loans-like 72 or 84 months-mean you’ll be upside down for years. If your car is totaled or stolen, your insurance won’t cover the full loan balance. You’ll still owe thousands. Plus, you’re locking yourself into a payment for way longer than the car’s reliable life.