Does Anyone Have an 850 Credit Score? Here’s What It Really Takes

Feb, 12 2026

Feb, 12 2026

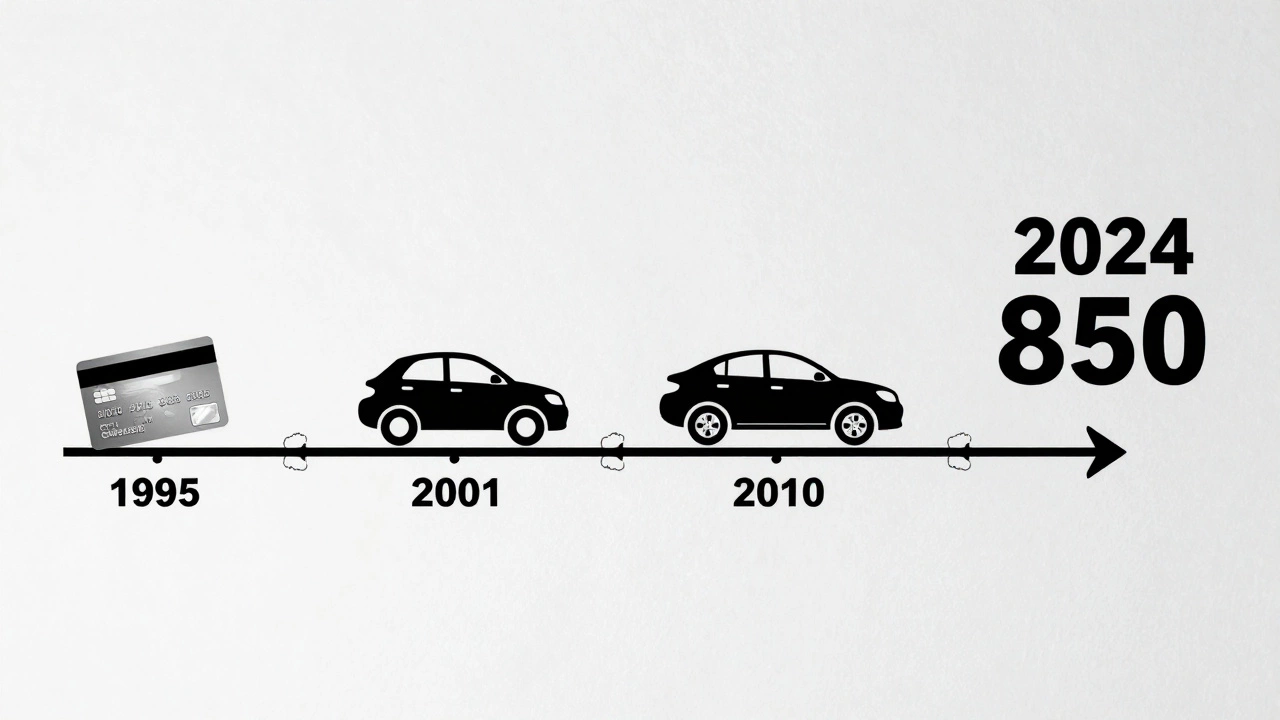

Ever wonder if a perfect 850 credit score is real-or just a myth pushed by credit card ads? You’re not alone. People scroll through forums, watch YouTube videos, and ask friends: Does anyone have an 850 credit score? The answer isn’t just yes-it’s more common than you think. But here’s the twist: getting there isn’t about magic tricks or secret formulas. It’s about consistency, time, and smart habits.

What Does an 850 Credit Score Actually Mean?

The FICO score, used by 90% of U.S. lenders, runs from 300 to 850. An 850 isn’t a mythical unicorn-it’s the top of the scale. You don’t need to be a financial genius or earn six figures to hit it. What you do need is decades of flawless payment history, low credit utilization, and a mix of well-managed accounts.

According to FICO’s latest data, about 1.6% of Americans have a score of 850. That’s roughly 1 in 60 people. It’s rare, but not impossible. And unlike the 800+ crowd, who might have one or two late payments in their past, 850 scorers almost never miss a payment. Not once. Not in 15, 20, or 30 years.

Who Has an 850 Credit Score? Real People, Real Stories

Meet Sarah, 58, from Ohio. She’s had the same credit card since 1992. She pays it off in full every month. She took out a mortgage in 2001, paid it off early in 2015, and never opened another loan. She has two old credit cards, one with a $10,000 limit, and one with $5,000. She uses less than 5% of both. No car loans. No student debt. No payday loans. Just steady, simple habits.

Then there’s Marcus, 42, in Atlanta. He used to carry balances. Then he got serious after a job loss in 2012. He automated payments, kept his utilization under 3%, and never closed an old account-even when he got better offers. He now has six open accounts, all over ten years old. His score has been 850 for five years straight.

These aren’t outliers. They’re people who treated credit like a long-term relationship, not a tool to chase rewards.

The Five Rules of an 850 Credit Score

If you want to join the 1.6%, here’s what actually works:

- Never miss a payment. Even one 30-day late payment can drop you 100+ points. Set up autopay for everything-even if you pay it off later.

- Keep credit utilization under 5%. Most experts say under 30% is fine. But 850 scorers? They keep it below 5%. That means if you have a $10,000 limit, you’re spending under $500 per month.

- Don’t close old accounts. Your credit history length matters. Closing a 20-year-old card doesn’t erase its history, but it can hurt your utilization ratio and shorten your average account age.

- Use different types of credit-but don’t overdo it. Having a mix (credit card, auto loan, mortgage) helps. But opening new accounts just to check a box? That backfires. Lenders see it as risk.

- Limit new credit applications. Each hard inquiry knocks off 5-10 points. Apply for a new card once every 18-24 months, max. And only if you need it.

Why Most People Never Hit 850

Here’s the truth: most people don’t aim for 850 because they don’t need it. Once you’re above 800, you’re getting the best rates on loans, cards, and insurance. Going from 800 to 850 doesn’t get you a better APR on a car loan. It doesn’t get you a free vacation. It doesn’t even get you a higher credit limit.

So why bother? For some, it’s pride. For others, it’s peace of mind. But if you’re chasing 850 to get better rewards, you’re chasing the wrong thing. The top-tier credit cards-like the Chase Sapphire Reserve or American Express Platinum-don’t require 850. They require income, spending power, and a clean history. A 780 score gets you the same offers.

And here’s the kicker: constantly applying for new cards to boost your score? That’s how people tank their credit. Opening three cards in six months? You’ll see your score drop 30-50 points. It takes months to recover.

What Doesn’t Matter

Let’s clear up some myths:

- Having zero debt doesn’t help. You need active, managed accounts. A card with a $0 balance isn’t helping your score. You need to use it lightly and pay it off.

- Income doesn’t affect your score. Lenders care about your income when approving you. But FICO? It doesn’t know how much you make.

- Checking your score hurts. No. Soft inquiries (your own checks) don’t count. Only hard pulls from lenders do.

- More credit cards = better score. Wrong. More cards mean more risk of missed payments. It also raises your total available credit, which can tempt overspending.

How Long Does It Take to Reach 850?

You can’t rush it. The average 850 scorer has been using credit for over 25 years. Most started in their early 20s. That’s not a coincidence. Credit scoring models reward longevity. Two 20-year-old accounts with perfect payment histories will outscore three new cards with 90% utilization.

Here’s a realistic timeline:

- Age 22-28: Get your first card. Use it for small purchases. Pay it off. Keep it open.

- Age 28-35: Add a second card. Maybe a car loan. Keep utilization low. Never miss a payment.

- Age 35-45: Take out a mortgage. Pay it on time. Don’t refinance unless you save big.

- Age 45-55: You’re building history. Your score climbs steadily. You’re now in the 800+ range.

- Age 55+: If you’ve stayed disciplined, 850 is within reach.

There’s no shortcut. You can’t buy your way there. You can’t game the system. It’s time + consistency.

Should You Even Try for 850?

Maybe. Maybe not.

If you’re already at 800, you’re getting the best rates in the market. You’re not paying extra for insurance. You’re approved for every premium card. You’re in the top 10% of borrowers. Is pushing to 850 worth the mental energy? Probably not.

But if you love tracking your finances, enjoy the discipline, or want to prove you can do it-go for it. Just don’t do it for the wrong reasons. Don’t open new accounts. Don’t chase points. Don’t stress over a 10-point difference.

Because here’s what really matters: if you’re managing credit responsibly, your score will climb naturally. And when you get there, you’ll realize it wasn’t about the number. It was about the habits.

Is an 850 credit score better than a 800?

In practical terms, no. Once you’re above 800, lenders treat you the same. You’ll get the same interest rates, credit limits, and card approvals. The difference between 800 and 850 is mostly psychological. It doesn’t unlock new benefits.

Can you have an 850 credit score with no mortgage?

Yes. A mortgage isn’t required. What matters is payment history, credit utilization, and account age. Many 850 scorers have only credit cards. A mix of credit helps, but it’s not mandatory.

How often does your credit score update to 850?

Your score updates monthly when your creditors report to the bureaus. If you’ve maintained perfect habits for years, your score will stay at 850 consistently. It doesn’t fluctuate unless you open new accounts, miss payments, or max out cards.

Do credit card companies care if you have an 850 score?

They care more about your income and spending habits than your exact score. But an 850 score signals low risk, so you’ll get better offers-like higher limits, exclusive invites, and faster approvals. Still, you don’t need 850 to get premium cards.

Can your credit score go above 850?

No. The FICO score range caps at 850. Some alternative scoring models (like VantageScore) go up to 900, but lenders almost never use them. If you see a score over 850, it’s either a mistake or a different model.

Final Thought: It’s Not About the Number

People chase 850 like it’s a trophy. But credit scores aren’t meant to be won. They’re meant to reflect responsibility. The real reward isn’t the number on your screen-it’s the freedom that comes from never worrying about a late payment, a maxed-out card, or a denied loan.

If you’re already on track-paying on time, keeping balances low, not opening new accounts like they’re free candy-you’re already winning. The 850 score? That’s just the quiet confirmation that you’ve done it right.