Is it better to remortgage with an existing lender?

Feb, 19 2026

Feb, 19 2026

Remortgage Cost Calculator

Enter your mortgage details to see a comparison between staying with your current lender versus switching.

When your fixed-rate mortgage ends, you’re faced with a choice: stay with your current lender or shop around. Many people assume switching to a new lender is the smart move-after all, they’re chasing new customers with low rates. But what if your current lender already offers you a better deal than anyone else? Is it really better to remortgage with an existing lender?

Why staying with your current lender might be the easiest choice

Your current lender already knows your financial history. They’ve seen your payment record, your income, and your property’s value. That means they don’t need to recheck your credit score or revalue your home. This cuts out a lot of the hassle. No new solicitor, no new valuation fees, no extra paperwork. For many, that’s a big win.

Take Sarah, for example. She had a 5-year fixed deal with Nationwide. When it ended, they offered her a new 3-year fixed rate at 3.8%. She checked a few brokers and found one deal at 3.6%-but it came with a £1,500 arrangement fee and a £400 valuation fee. After running the numbers, Sarah realized she’d pay more in fees over three years than she’d save on interest. She stayed put.

Existing lenders often have retention deals built just for people like Sarah. These aren’t always advertised. You might need to call them directly or log into your online account to see what’s available. They don’t want to lose you, so they’ll sometimes offer a better rate than what’s on their public website.

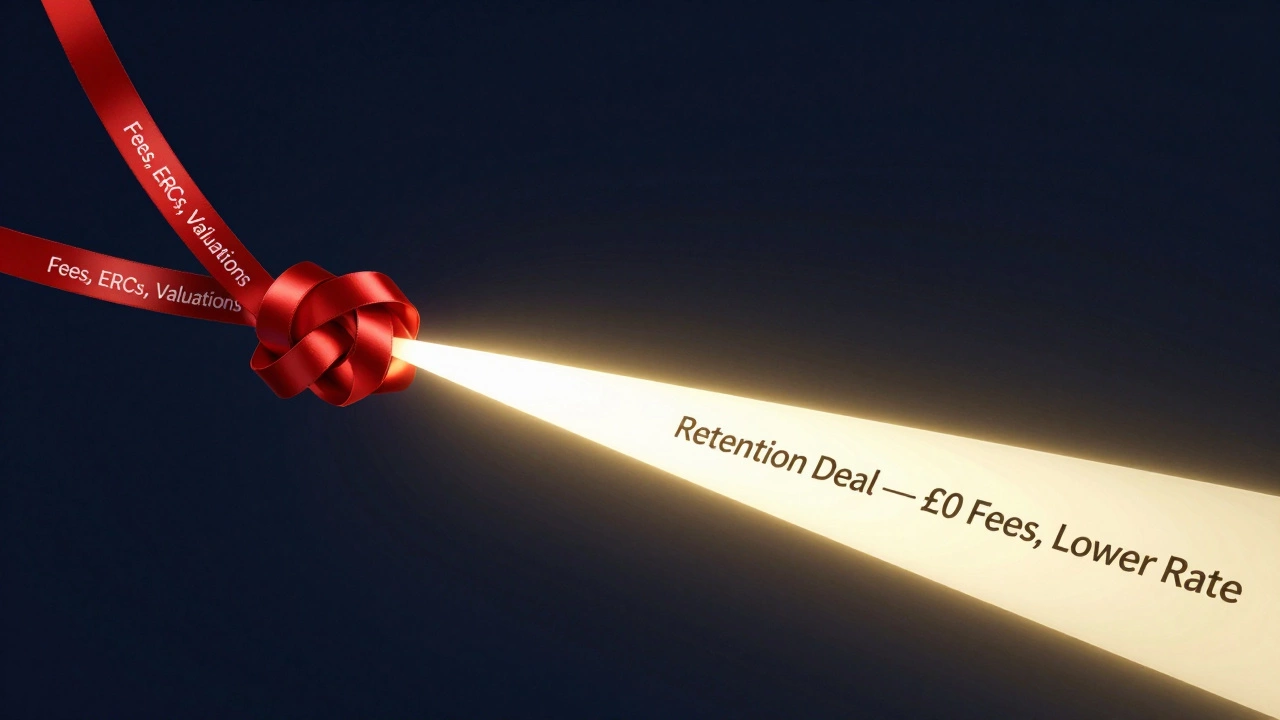

The hidden costs of switching lenders

Switching lenders sounds simple, but the costs add up fast. Here’s what most people forget:

- Valuation fee: £150-£1,000, depending on your home’s value

- Arrangement fee: £0-£2,500 (many deals have high fees to offset low rates)

- Legal fees: £800-£1,500 for solicitors

- Early repayment charges (ERCs): If you’re still in a fixed term, you could pay 1%-5% of your outstanding balance

Let’s say you owe £200,000 and your current lender offers a 3.7% rate. A new lender offers 3.2%, but with £2,000 in fees. You’d save £1,000 a year in interest. That sounds great-until you realize it takes two full years just to break even. And if you move again in three years? You’re out of pocket.

Most people don’t run these numbers. They see a lower rate and assume they’re saving. But without factoring in fees, you could be losing money.

What your current lender might not tell you

Here’s the thing: lenders aren’t required to show you every option they have. They’ll often push the deal they think you’ll accept, not the best one. If you call and ask, “What’s the lowest rate you can offer me right now?” you might get a better answer.

Some lenders have special retention products that aren’t listed online. For instance, Barclays’ “Existing Customer Rate Reduction” can be 0.3%-0.5% lower than their standard variable rate. HSBC offers a “Loyalty Discount” that cuts the rate by 0.25% if you’ve been a customer for over five years. These aren’t advertised on comparison sites.

Also, your lender might let you add a payment holiday, switch from interest-only to repayment, or extend your term without a full affordability check. These are things new lenders won’t do unless you reapply from scratch.

When you should definitely switch

Staying with your current lender isn’t always the right move. Here are clear signs you should switch:

- Your current rate is more than 0.75% higher than the best market rate

- You’re on their standard variable rate (SVR)-it’s usually the most expensive option

- Your lender has poor customer service-long wait times, no online tools, slow responses

- You want to borrow more money (e.g., for home improvements) and your current lender won’t let you

- You’ve improved your credit score or paid down debt and now qualify for better terms

For example, if you’re on a 5.2% SVR and the market average for a 2-year fixed is 4.1%, switching makes sense. Even with £1,800 in fees, you’d save over £2,200 a year. That pays for the fees in under a year.

Also, if your lender is about to merge with another company or has been flagged for poor customer satisfaction (like some smaller lenders in 2024), it’s worth looking elsewhere.

How to compare your options fairly

Don’t just compare interest rates. Compare the total cost over the term you’re considering. Here’s a simple way:

- Take your current mortgage balance and rate

- Find the best deal from your current lender (ask for it)

- Find the best deal from two other lenders

- Add all fees to each deal

- Calculate total interest paid over the next 2 or 3 years

- Subtract any savings from lower rates

Example: You owe £180,000.

| Option | Rate | Term | Fees | Interest Paid (3 Years) |

|---|---|---|---|---|

| Current lender (retention deal) | 3.9% | 3 years | £0 | £21,060 |

| New lender A | 3.6% | 3 years | £1,800 | £19,440 + £1,800 = £21,240 |

| New lender B | 3.4% | 3 years | £2,200 | £18,360 + £2,200 = £20,560 |

In this case, New Lender B wins. But if their fees were £2,500 instead? Then your current lender becomes the better option.

What lenders don’t want you to know

Most lenders make more money from customers who stay put than from new ones. Why? Because switching costs money-for them too. They pay brokers, advertising, and compliance checks to win new business. Keeping you costs them almost nothing.

So they’ll offer you a “good” deal-not the best. But if you push back, they often have a better one hidden in their system. It’s called a “customer loyalty discount.” Some lenders even have a “no fee remortgage” option for long-term customers.

Don’t be afraid to say: “I’m considering leaving. Can you beat this offer?” Even if you don’t mean it, it often triggers a better offer.

Final decision checklist

Before you decide, ask yourself:

- Am I on the SVR? If yes, switching is likely worth it.

- Have I checked my current lender’s retention offers? Call them.

- Do I have enough equity to qualify for better deals elsewhere? (At least 20% is ideal.)

- Will I be hit with an early repayment charge? If so, how much?

- Am I okay with the paperwork and delays of switching?

- Do I trust my current lender? Or do I have a history of bad service?

If you answered yes to more than three of these, you’re probably better off switching. If most answers are no, staying put might be smarter.

Bottom line

There’s no universal answer. It depends on your numbers, your lender, and your goals. But most people assume switching is always better-and they’re wrong. Staying with your current lender can save you time, money, and stress. Just don’t accept the first offer they give you. Ask for the best one. And always, always run the numbers before you sign anything.