Should You Close a Credit Card with Zero Balance or Keep It Open?

Feb, 2 2026

Feb, 2 2026

Credit Card Utilization Calculator

How Your Credit Cards Affect Your Score

Close a credit card with zero balance? Learn how it impacts your credit utilization and score before you decide.

Current Credit Utilization

Healthy utilization is under 30%, preferably under 10%

After Closing Selected Card

Potential score impact based on utilization change

Recommendations

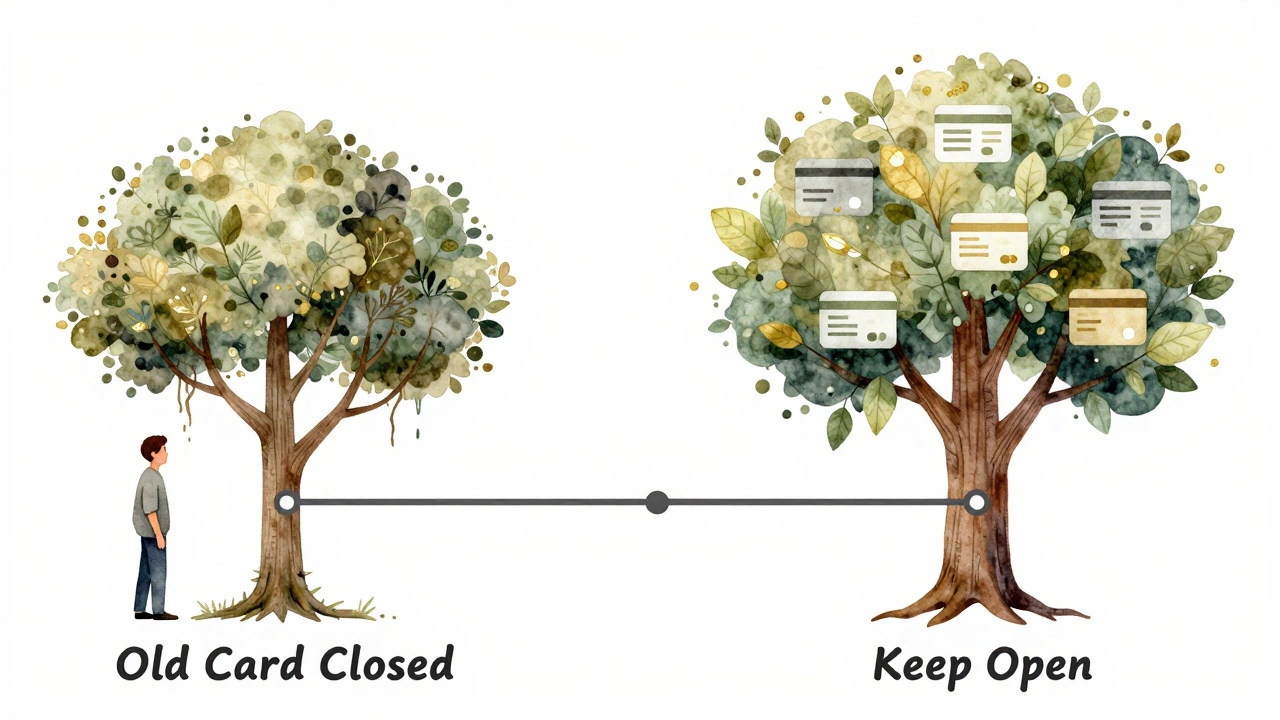

Many people think closing a credit card with a zero balance is a smart move-especially if they’re not using it. But that simple action can quietly hurt your credit score more than you realize. It’s not about the balance. It’s about what happens behind the scenes when you shut that account down.

Why Your Credit Utilization Ratio Matters

Your credit utilization ratio is the percentage of your total available credit that you’re actually using. Lenders love to see this number stay under 30%. Below 10%? Even better. When you close a credit card, you lose that card’s credit limit from the total pool. Suddenly, your utilization jumps-even if you haven’t spent more.

Let’s say you have two cards: Card A with a $5,000 limit and a $1,000 balance, and Card B with a $3,000 limit and a $0 balance. Your total credit is $8,000. You’re using $1,000, so your utilization is 12.5%. Now you close Card B. Suddenly, your total credit drops to $5,000. Your utilization spikes to 20%. That’s a 7.5-point jump in one move. If you had a third card with a $2,000 limit and a $1,500 balance, closing Card B would push your utilization to 50%. That’s a red flag for credit scoring models.

Length of Credit History Isn’t Just a Number

Your credit history length makes up about 15% of your FICO score. The older your accounts, the better. Closing a card doesn’t erase its history-it stays on your report for up to 10 years. But here’s the catch: once it’s closed, it no longer counts toward your active credit history. If that card was your oldest, you could lose the benefit of that long track record.

Imagine you opened your first credit card at 19. It’s now 12 years later. You’ve built a solid score, but you don’t use that card anymore. You close it. Suddenly, your next oldest card is only 5 years old. Your average account age drops. That’s not a disaster, but it’s a slow leak in your credit profile. And if you’re applying for a mortgage or car loan soon, even small drops matter.

When Closing a Card Actually Makes Sense

There are times when closing a card is the right move. If you’re paying an annual fee you don’t need-especially if the card has no rewards anymore-it’s okay to cut it. If you’ve got a history of overspending on that card and you know you can’t trust yourself not to use it, closing it might protect your finances more than your credit score.

Another case: if you have multiple cards from the same issuer and one has a much lower limit than the others. Closing the low-limit card won’t hurt your utilization much, and you might even get approved for a better card later with a higher limit.

But here’s the rule: only close a card if you have at least two other open cards with healthy limits and low balances. And never close your oldest card unless you’ve got another one that’s nearly as old.

What Happens When You Close a Card?

When you call to close a card, the issuer will likely try to talk you out of it. They might offer to waive the annual fee or bump your limit. Don’t be surprised-it’s their job to keep you as a customer. But if you’re firm, they’ll process the closure. After that:

- The card’s credit limit disappears from your total available credit.

- Your credit utilization ratio goes up.

- Your average account age drops.

- The account status changes from “open” to “closed” on your credit report.

- It stays on your report for 10 years, but stops helping your active credit history.

Some people think closing a card removes debt from their record. It doesn’t. You had no balance, so there was no debt to remove. What you’re removing is your financial breathing room.

Alternatives to Closing

You don’t have to close a card to stop using it. Try these instead:

- Keep it in a drawer. Don’t carry it. Don’t use it. But leave it open.

- Set up a small recurring charge-like a $2 Netflix subscription or a $5 Spotify payment-and pay it off automatically. This keeps the account active without risking overspending.

- Ask the issuer to upgrade it to a no-fee version. Many issuers will do this if you call.

- Transfer the credit limit to another card from the same bank. Some banks let you move limits between accounts without closing the original.

These options keep your credit utilization low and your credit history intact. They’re safer than closing.

What Credit Score Experts Say

FICO and VantageScore both say the same thing: keeping unused cards open helps your score. A 2023 study by the Consumer Financial Protection Bureau found that people who closed unused credit cards saw their scores drop an average of 12 points within three months. Those who kept them open saw no change-or even a small increase.

That’s not a fluke. It’s math. And it’s predictable. The same study showed that the biggest score drops happened to people who closed their oldest card or had high utilization before closing.

Real-Life Example: Maria’s Story

Maria had three credit cards. Her oldest was from college-$2,000 limit, $0 balance. She didn’t use it. She had two others: one with a $10,000 limit and a $2,000 balance, and another with a $5,000 limit and a $500 balance. Her utilization was 16%. She closed the old card to “clean up” her finances.

Three weeks later, she applied for a car loan. Her credit score dropped from 762 to 738. The lender offered her a higher interest rate. She didn’t understand why. She hadn’t missed a payment. She had no debt.

When she checked her report, she saw the closed account. Her average age of accounts dropped from 11 years to 6. Her utilization jumped to 24%. She reopened the card and started using it for a $10 monthly bill. Within two months, her score climbed back to 759.

Final Rule: Think Before You Close

Never close a credit card just because you’re not using it. Ask yourself:

- Is this my oldest card?

- Do I have other cards with high limits?

- Am I carrying balances on other cards?

- Is there an annual fee I can avoid instead?

If you answered yes to any of the first three, keep the card open. Even if it’s just sitting there. Let it work for you in the background.

If you’re tempted to close it because you’re worried about fraud or overspending, talk to your issuer. Ask for a lower limit. Freeze the card. Set up alerts. You don’t need to cut it off to stay safe.

Your credit score isn’t about how many cards you have. It’s about how you manage what you’ve got. Leaving a zero-balance card open isn’t a mistake. It’s a quiet advantage.

Will closing a credit card with zero balance hurt my credit score?

Yes, it can. Closing a card reduces your total available credit, which raises your credit utilization ratio. It also lowers your average account age. Both of these can cause your score to drop, especially if you have few other cards or carry balances on others.

How long does a closed credit card stay on my credit report?

A closed credit card account stays on your report for up to 10 years from the date it was closed. During that time, it still contributes to your credit history length, but it no longer counts toward your available credit or utilization ratio.

Should I close a credit card if it has an annual fee?

Only if you have other cards with higher limits and you’re not relying on this one for your credit history. If it’s your oldest card or you have few other accounts, call the issuer first. Many will waive the fee or downgrade the card to a no-fee version.

Can I close a card and still keep my credit score high?

Only if you have multiple other open cards with high limits and low balances. If your utilization stays under 10% and your oldest account remains open, the impact will be minimal. But if you’re only carrying one or two cards, avoid closing any.

What’s the best way to keep a credit card active without using it?

Set up a small recurring payment-like a $5 subscription-and pay it off automatically each month. This keeps the account active, avoids inactivity fees, and shows lenders you’re managing credit responsibly.