What Disqualifies You from Getting a Home Equity Loan?

Oct, 22 2025

Oct, 22 2025

Home Equity Loan Eligibility Calculator

Calculate Your Eligibility

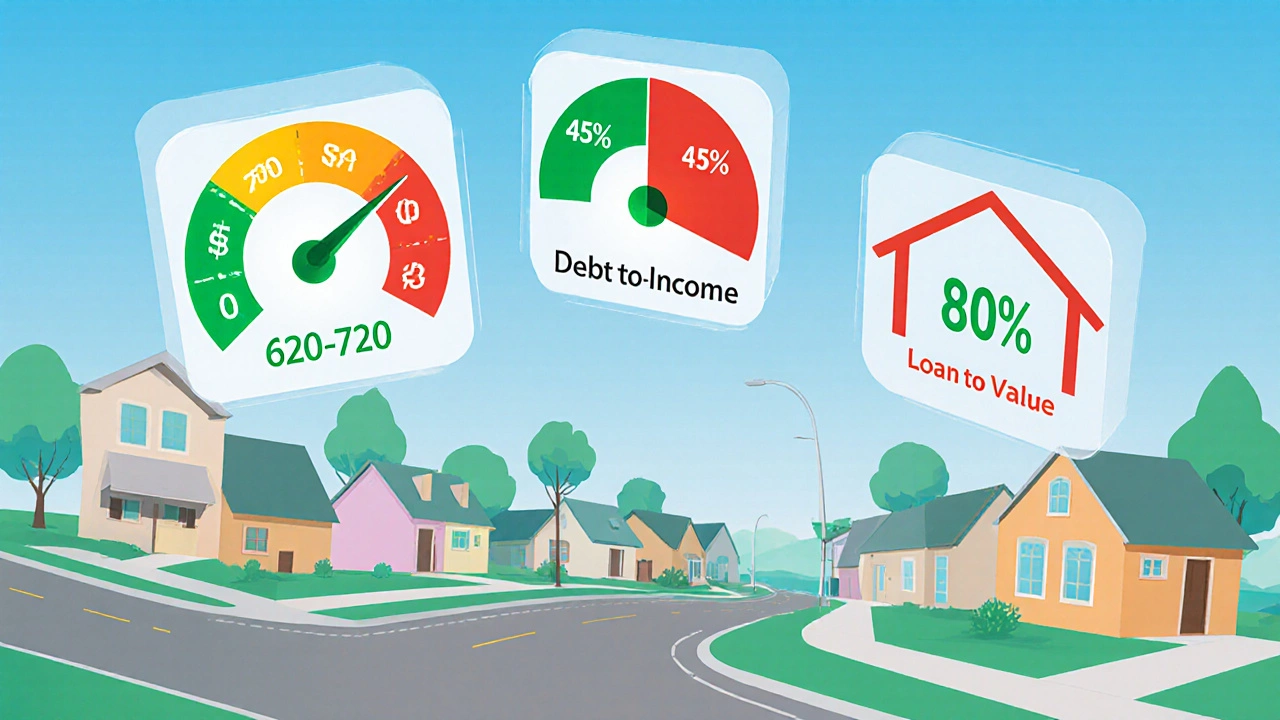

Enter your financial details to see if you qualify for a standard home equity loan (80% LTV, 45% DTI, 620 credit score minimum).

Results

When you start thinking about tapping the equity in your house, the first question that pops up is often, "Will I get approved?" The answer hinges on a handful of concrete criteria that lenders use to protect themselves - and you. Below we break down every common reason a lender might say no, explain how each factor is calculated, and give you practical steps to fix the problem before you apply.

Understanding the Core Eligibility Pillars

Most lenders boil down the decision to three numeric pillars: credit score, Debt‑to‑Income Ratio (the percentage of your monthly gross income that goes toward debt payments), and Loan‑to‑Value Ratio (the amount you want to borrow divided by the appraised value of your home). If any of these fall outside a lender’s comfort zone, you’ll be disqualified.

1. Credit Score - The First Gatekeeper

In Canada, most banks require a minimum Credit Score (a three‑digit number that reflects your creditworthiness) of 620 for a home equity loan. A score below that signals higher risk, and many lenders will outright reject the application.

- Why it matters: A higher score shows you’ve managed debt responsibly, suggesting you’ll repay the loan on time.

- Typical thresholds: 620‑679 = "fair", 680‑739 = "good", 740+ = "excellent". The better the band, the more loan options you’ll see.

How to improve:

- Pay down revolving balances on credit cards to bring utilization under 30%.

- Correct any errors on your credit report - a single mis‑recorded missed payment can knock off dozens of points.

- Avoid opening new credit lines in the months leading up to your application.

2. Debt‑to‑Income Ratio (DTI) - Can You Afford More Debt?

Lenders calculate DTI by adding up all recurring monthly debt obligations - mortgage, car loans, credit‑card minimums, student loans - and dividing that sum by your gross monthly income. Most Canadian lenders set a hard ceiling at 45%; some elite programs stretch to 50% if you have an excellent credit score.

Example: If you earn $7,000 a month before tax and your total monthly debts total $3,200, your DTI is 45.7% - likely a red flag.

- How it’s measured: Include all debt payments that appear on your credit report plus your existing mortgage payment.

- What disqualifies you: Anything above the lender’s stated limit, typically 45% for standard home equity loans.

Ways to lower DTI:

- Pay off or refinance high‑interest credit cards.

- Increase household income - a part‑time job, freelance work, or a spouse’s earnings.

- Delay the loan application until you’ve cleared smaller debts.

3. Loan‑to‑Value Ratio (LTV) - How Much Equity Do You Actually Have?

The Loan‑to‑Value Ratio (borrowed amount ÷ current appraised value of the home) is the most direct measure of equity release risk. Most lenders cap LTV at 80% for a standard home equity loan, meaning you can borrow up to 80% of the home’s value after subtracting any existing mortgage balance.

Example: Your house is appraised at $600,000 and you owe $300,000 on a mortgage. 80% of $600,000 is $480,000, so you could theoretically borrow up to $180,000 (the difference between $480,000 and the $300,000 existing mortgage). Anything above $180,000 would push the LTV beyond 80% and trigger a denial.

- Why lenders care: Higher LTV means less cushion if property values drop, raising the chance of default.

- Typical limits: 80% for most banks, up to 85% for credit unions that specialize in equity products.

Boost your LTV eligibility:

- Get a fresh, professional Property Appraisal (an official estimate of your home’s market value). Renovations, improved curb appeal, and recent comparable sales can raise the appraised value.

- Pay down the existing mortgage to free up equity.

- Consider a lower loan amount that stays comfortably within the 80% ceiling.

4. Bankruptcy or Consumer Proposal - A Hard Disqualifier

If you’ve filed for personal bankruptcy or a consumer proposal within the last seven years, most lenders will automatically reject a home equity loan application. The reason is simple: a recent bankruptcy signals a high probability of future default.

Exceptions exist only with specialized “re‑build” lenders, but those typically charge steep interest rates and require a large cash‑reserve buffer.

5. Foreclosure or Short Sale History

Having a foreclosure or a short sale on your credit record within the past five years is another red flag. Even if the event happened many years ago, lenders may view it as a lingering risk, especially if you have other negative credit items.

Mitigation strategy: Provide a clear explanation of the circumstances, show a solid payment history since the event, and offer a higher down‑payment to lower the LTV.

6. Insufficient Income Documentation

Lenders need proof that you can handle the additional monthly payment. If you’re self‑employed, a freelancer, or have fluctuating income, you’ll need at least two years of Notice of Assessment (NOA) statements from the CRA, plus recent bank statements showing stable cash flow.

Missing or incomplete documentation often results in a quick denial, because the lender can’t verify repayment capacity.

7. Property Type and Condition Restrictions

Not all homes qualify. Condominiums, mobile homes, and properties with significant structural issues may be excluded from a home equity loan program. Lenders usually require the home to be a primary residence in good repair.

If you own a condo, check whether the condo corporation’s bylaws allow equity loans - some prohibit extra liens on units.

Comparison Table of Common Disqualifiers

| Disqualifier | Typical Threshold | Effect on Application |

|---|---|---|

| Credit Score | Below 620 | Automatic rejection or need for a high‑interest alternative |

| Debt‑to‑Income Ratio | Above 45% (standard) / 50% (premium) | Denied or required to lower loan amount |

| Loan‑to‑Value Ratio | Above 80% (most banks) / 85% (some credit unions) | Denied unless you bring LTV down with a larger down‑payment |

| Bankruptcy / Consumer Proposal | Within 7 years | Usually disqualified |

| Foreclosure / Short Sale | Within 5 years | High risk - often denied |

| Insufficient Income Docs | Missing NOA or bank statements | Application halted |

| Non‑qualifying Property Type | Condo restrictions, mobile homes, severe damage | Denied or limited to lower amounts |

How to Strengthen Your Application Before You Apply

Once you know the roadblocks, you can take concrete steps to clear them. Here’s a quick checklist you can follow over the next 30‑60 days.

- Obtain a free copy of your credit report from Equifax or TransUnion. Flag any errors and dispute them.

- Pay down credit‑card balances to bring utilization below 30%.

- Calculate your current DTI. If it’s above 45%, prioritize paying off the smallest debt first (the "snowball" method) or refinance a high‑interest loan.

- Schedule a professional appraisal. Even a modest 5% increase in value can improve your LTV dramatically.

- Gather two years of CRA Notice of Assessment, recent payslips, and bank statements. Organize them in a dedicated folder for the lender.

- If you’ve had a bankruptcy or foreclosure, prepare a concise written explanation and evidence of stable payments since the event.

- Consider a smaller loan request that stays comfortably under the 80% LTV limit. You can always apply for a second draw later if needed.

Taking these actions not only boosts your odds of approval but also positions you for a better interest rate, which saves money over the life of the loan.

Frequently Asked Questions

Can I still get a home equity loan if I’m self‑employed?

Yes, but you’ll need stronger documentation. Lenders typically ask for two years of CRA Notice of Assessment, recent bank statements showing consistent cash flow, and sometimes a personal financial statement. A higher credit score and lower DTI can offset the perceived risk.

Is a condo ever eligible for a home equity loan?

It depends on the condo corporation’s bylaws. Some restrict additional liens, while others allow them up to a certain LTV. Check with the board and your lender before applying.

How long does a lender keep my application on hold due to missing documents?

Most lenders give you a 7‑day window to submit additional paperwork. If you miss that, the file is usually closed and you’ll need to start over.

Will applying for a home equity loan affect my credit score?

A hard inquiry is recorded, typically costing 5‑10 points. The impact is temporary; paying the loan on time can actually improve your score over time.

What’s the difference between a home equity loan and a HELOC?

A home equity loan gives you a lump‑sum with a fixed rate and repayment schedule, while a Home Equity Line of Credit (HELOC) works like a credit card - you borrow, repay, and borrow again up to a limit, usually with a variable rate.

Next Steps After You’ve Fixed the Issues

When you’ve tackled the most common disqualifiers, it’s time to shop around. Different lenders have slightly varied thresholds - a credit union might approve a 78% LTV while a big bank sticks to 75%.

Use a comparison tool or speak directly with a mortgage broker who can run a soft pre‑approval. That way you’ll know exactly where you stand before any hard credit pull.

Remember, the goal isn’t just to get approved; it’s to secure a loan that fits your budget and protects the equity you’ve built over years. By understanding and correcting the red flags listed above, you’ll walk into the lender’s office with confidence and a clear path to the cash you need.