What Is the Average 401(k) Return Over 30 Years?

Dec, 1 2025

Dec, 1 2025

401(k) Compound Growth Calculator

How Your 401(k) Grows Over 30 Years

Based on historical data, most 401(k) plans return 6-7% after inflation over long periods. See how small differences in returns create big differences in your retirement savings.

People ask about the average 401(k) return over 30 years because they want to know if their savings will be enough to retire. The answer isn’t a single number-it depends on how you invest, when you start, and what the market does. But if you’re looking for a realistic expectation, most financial experts point to an average annual return between 6% and 7% after inflation over long periods. That’s not flashy, but it’s reliable. Over 30 years, that small difference in annual return makes a massive difference in your final balance.

How 6% vs. 7% Changes Everything

Let’s say you contribute $200 a month to your 401(k). That’s $2,400 a year. At 6% annual return, compounded monthly, you’d end up with about $205,000 after 30 years. At 7%, you’d have roughly $240,000. That’s a $35,000 gap-just from a 1% higher return. Now imagine you’re putting in $500 a month. At 6%, you hit $513,000. At 7%, you hit $600,000. That’s an extra $87,000. The math doesn’t lie: even small changes in return compound into life-changing amounts.

Why does this happen? Because of compound growth. Each year, your earnings earn their own earnings. Early contributions matter more than you think. Someone who starts at 25 with $200 a month and earns 7% will have nearly twice as much at 55 as someone who starts at 35 with the same monthly amount-even if that second person saves $400 a month. Time beats effort every time.

Where Does the 6%-7% Number Come From?

This range isn’t pulled out of thin air. It’s based on historical data from the S&P 500, which is the benchmark most 401(k) plans track. From 1926 to 2024, the S&P 500 returned about 10% annually before inflation. But inflation averaged 2.9% over that same period. That leaves a real return of roughly 7%. When you factor in fees, underperformance of mutual funds, and the fact that most 401(k)s aren’t 100% in stocks, 6%-7% becomes the realistic long-term expectation.

Most 401(k) plans offer target-date funds, which automatically shift from stocks to bonds as you near retirement. These funds typically return between 5.5% and 6.8% over 30 years, depending on their asset mix. Vanguard’s 2055 Target Date Fund, for example, returned 6.9% annually from 1995 to 2024. Fidelity’s 2050 fund returned 6.3%. These aren’t outliers-they’re the norm.

What Affects Your Actual Return?

Your return isn’t just about the market. It’s about what you do with your account. Here are the big three factors:

- Investment choices: If you keep your money in cash or low-yield bonds, you’ll earn less than 3%-and lose buying power to inflation. If you’re 10+ years from retirement, you should have at least 70% in stock funds. The rest can be in bonds or stable value funds.

- Costs: Expense ratios matter. A fund charging 1% annually eats away $10,000 over 30 years on a $100,000 balance. Index funds often cost 0.05%-0.15%. Stick with low-cost options. Fidelity, Vanguard, and Schwab all offer index funds under 0.10%.

- Consistency: Missing even a few years of contributions can cost you tens of thousands. If you stop saving for five years in your 30s, you might lose $50,000-$80,000 by retirement. Set up auto-contributions and never turn them off unless you’re in crisis.

Also, don’t ignore your employer’s match. That’s free money. If your company matches 50% of your first 6%, you’re getting an instant 50% return. That’s better than any stock pick. Skip the match, and you’re leaving money on the table.

What About Market Crashes?

You’ve heard the stories: the dot-com bubble, the 2008 crash, the 2020 pandemic drop. People panic and sell. But history shows that staying invested pays off. The S&P 500 lost over 37% in 2008. But if you held on, you were back to even by 2012. Over the next decade, it tripled. A 30-year investor who bought in 1995 and held through every crash ended up with a 9.4% annual return. That’s above average.

The key isn’t timing the market. It’s time in the market. If you’re young, downturns are your friend. When prices fall, you’re buying more shares for the same dollar. That lowers your average cost per share. That’s dollar-cost averaging in action. Don’t try to guess when the bottom is. Just keep contributing.

What Should Your 30-Year 401(k) Balance Be?

There’s no magic number, but most advisors say you should aim for 10 times your final salary by retirement. If you earn $70,000 a year at 65, you’ll want $700,000 saved. That’s doable with consistent investing.

Here’s a simple rule: save 15% of your income each year-including employer match. If you start at 25, earn $50,000, and get a 3% raise each year, you’ll hit $750,000 by 55 with a 7% return. That’s enough to pull $30,000 a year in retirement (adjusted for inflation) without running out.

But if you start at 35? You’ll need to save 20%-25% to catch up. If you’re 45? You’re looking at 30% or more. The later you start, the harder it gets. That’s why early action matters more than the exact return.

Real People, Real Results

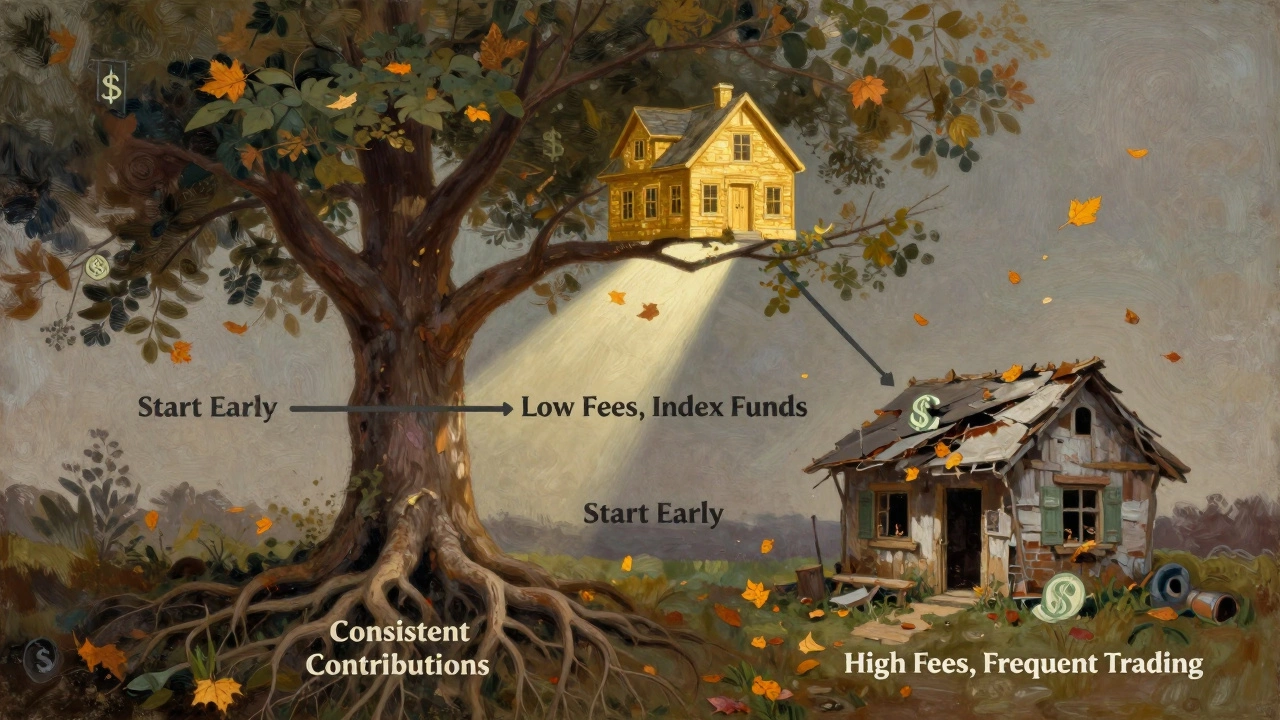

Take Maria, 42, from Ohio. She started contributing $250 a month at 27. She switched to a low-cost index fund at 30. She never missed a contribution, even during layoffs. She’s now 42, with $185,000 saved. She’s on track for $600,000 by 65. She didn’t get lucky. She just stayed consistent.

Compare that to James, 40, from Texas. He started at 25 but switched funds every year chasing ‘hot’ performers. He paid high fees. He pulled out in 2008 and didn’t get back in until 2011. He’s now at $85,000. He’s working longer. He didn’t have bad luck-he had bad habits.

The difference isn’t luck. It’s behavior.

What If You’re Behind?

If you’re 50 and have only $100,000 saved, don’t give up. You still have time. Max out your 401(k)-$30,500 in 2025 if you’re 50 or older. That includes the $7,500 catch-up contribution. Even at 6% return, putting in $30,500 a year for 10 years gets you to $410,000. Add Social Security and a little part-time work, and you’re still in a good spot.

Don’t try to chase 12% returns with crypto or options. That’s gambling. Stick with low-cost index funds. Increase your contribution by 1% every year. Even $50 extra a month adds $15,000 over 10 years. Small steps matter.

Final Thought: It’s Not About the Average

The average 401(k) return over 30 years is a useful number-but it’s not your goal. Your goal is to build a retirement you can live on. That means starting early, staying invested, keeping costs low, and never giving up. The market doesn’t care how you feel. It doesn’t reward timing. It rewards patience. And over 30 years, patience turns modest returns into freedom.

What is the average 401(k) return over 30 years?

The average annual return for a diversified 401(k) over 30 years is typically between 6% and 7% after inflation. This is based on historical S&P 500 performance adjusted for fees, asset allocation, and market volatility. Higher returns are possible with aggressive investing, but 6%-7% is a realistic, sustainable expectation for most investors.

Can I expect 10% returns from my 401(k)?

Before inflation, the S&P 500 has returned about 10% annually over the last century. But most 401(k) investors don’t get that full return. Fees, underperformance of actively managed funds, and shifting allocations to bonds as you age reduce your actual return. After inflation and expenses, 6%-7% is more realistic. Chasing 10% often leads to risky bets that hurt long-term results.

How much should I have in my 401(k) after 30 years?

If you save 15% of your income annually and earn a 7% return, you’ll have about 10 times your final salary saved by retirement. For example, earning $70,000 at retirement means aiming for $700,000. Starting early and staying consistent matters more than the exact return. Someone who saves $200/month from age 25 to 55 with 7% returns ends up with about $240,000. Someone who saves $500/month ends up with $600,000.

Does inflation affect my 401(k) return?

Yes, inflation eats away at your buying power. A 10% nominal return sounds great, but if inflation is 3%, your real return is only 7%. That’s why financial planners focus on real returns-what your money can actually buy in the future. Always compare returns after inflation. If your 401(k) fund doesn’t show real returns, assume 2.5%-3% inflation and subtract it from your stated return.

Should I change my 401(k) investments as I get older?

Yes, but not too early. If you’re under 40, you should have 80%-90% in stocks. At 50, shift to 60%-70% stocks. By 60, aim for 50%-60% stocks. Target-date funds do this automatically. Don’t move too conservative too soon-you risk outliving your savings. The goal isn’t to avoid losses. It’s to make sure your portfolio lasts 30+ years in retirement.

What happens if I stop contributing to my 401(k) for a few years?

Stopping for even five years in your 30s can cost you $50,000-$80,000 by retirement, even with a 7% return. That’s because you lose both the contributions and the compound growth on them. If you lose your job or face hardship, pause if you must-but restart as soon as you can. The longer you wait, the harder it is to catch up. Never stop for more than a year if you can help it.