What Is the Lowest Credit Score to Borrow? Bad Credit Loan Limits Explained

Jan, 12 2026

Jan, 12 2026

Bad Credit Loan Cost Calculator

Calculate Your Loan Cost

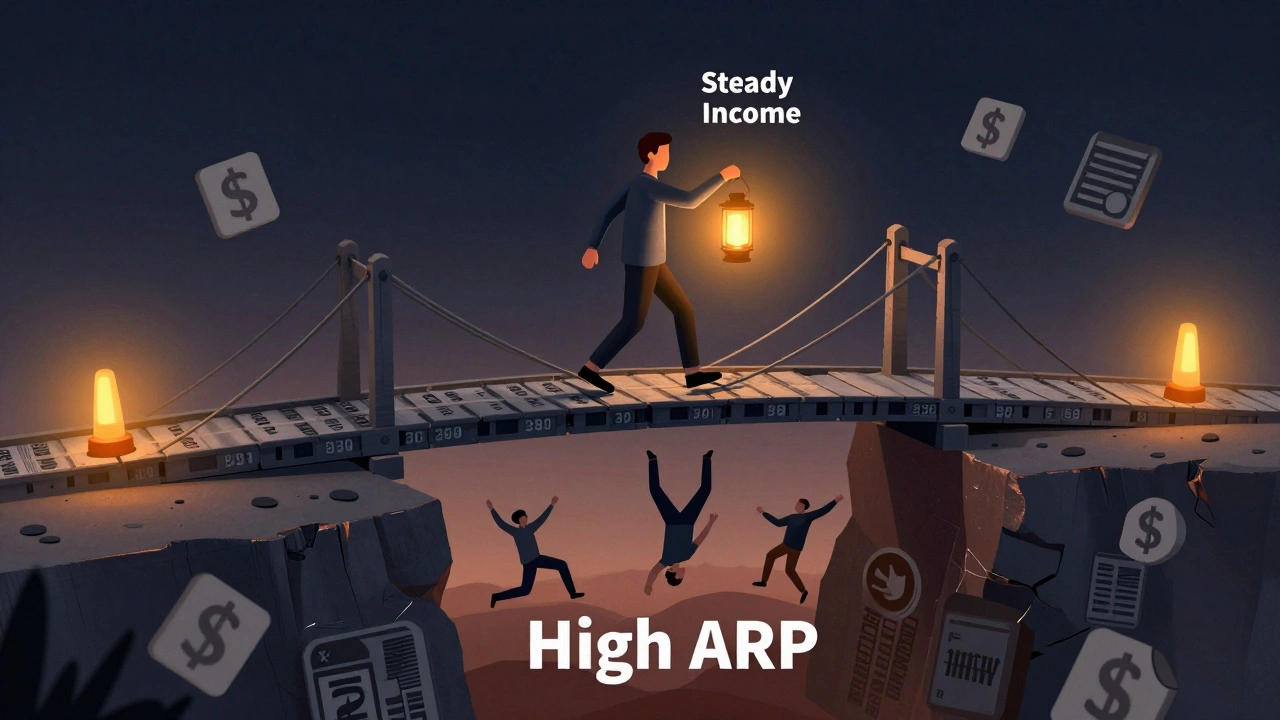

See how much you'll pay in interest for a loan based on your credit score. Higher APRs from bad credit loans cost thousands more.

For example: A $5,000 loan at 30% APR over 3 years costs $2,560 in interest. At 10% APR, it's $800. That's a $1,760 difference.

People with bad credit aren’t locked out of borrowing - but they need to know the real numbers. There’s no single magic number like 500 or 580 that applies to everyone. The lowest credit score you can have and still get a loan depends on the lender, the type of loan, and what you’re willing to pay. Some lenders approve borrowers with scores as low as 300. Others won’t even look at you unless you’re above 580. So what’s actually possible? And what does it cost?

There’s no universal minimum credit score

You’ll hear different answers from different sources. One lender says 580. Another says 500. A third says they’ve approved someone with a 350. That’s because there’s no federal rule, no law, and no industry standard that says you need a certain score to borrow. Each lender sets their own rules based on risk, profit, and how they’ve seen people pay back loans in the past.

Subprime lenders - the ones that specialize in bad credit - often work with scores between 300 and 579. That’s the range most people think of as “poor” or “very poor” credit. But even within that range, approval isn’t guaranteed. One lender might approve a 450 if you have a steady job and a down payment. Another might reject you for the same score because you’ve had a recent bankruptcy.

It’s not just about the number. Lenders look at your income, employment history, debt-to-income ratio, and whether you’ve paid anything off recently. A score of 480 with a $4,000 monthly income and no new debt in the last year has a better shot than a 520 with three recent collections and no job.

What credit score ranges mean in practice

Most lenders use FICO scores, which run from 300 to 850. Here’s how those numbers break down and what they actually mean for borrowing:

- 300-579: Very Poor - You can still get loans, but only from specialized lenders. Expect high interest rates (25% to 36% APR), small loan amounts ($500-$2,500), and strict repayment terms.

- 580-669: Fair - You’ll have more options. Some banks and credit unions offer personal loans here. Rates drop to 15%-25% APR. Loan amounts can reach $10,000.

- 670-739: Good - You’re in the mainstream. Most lenders will approve you with rates under 12% APR.

People with scores below 580 are often turned down by big banks and credit unions. But they’re not out of luck. Online lenders like Upstart, Avant, and OneMain Financial regularly lend to people with scores in the 500s. Some even accept 400s - if you meet other conditions.

How low can you go? Real examples

In 2025, a 28-year-old woman in Ohio got a $2,000 personal loan with a 34% APR despite having a credit score of 380. How? She had been working at the same job for 3.5 years, made $3,200 a month, and had no new debt in 14 months. The lender saw stability, not just the score.

A man in Texas with a 410 score got approved for $1,500 from a tribal lender. His loan had a 48% APR and a 12-month term. He paid it off in 8 months and used the savings to rebuild his credit.

These aren’t rare cases. In 2024, the Consumer Financial Protection Bureau found that lenders approved 18% of applicants with scores below 500. That’s nearly 1 in 5 people. But approval doesn’t mean it’s smart.

What you’ll pay for a low credit score loan

Low scores come with high costs. A $5,000 loan at 30% APR over 3 years costs you $2,560 in interest. At 10% APR, it’s just $800. That’s a $1,760 difference - more than the original loan amount.

Here’s what bad credit loans usually look like:

- APR range: 25% to 48%

- Loan amount: $500 to $5,000 (rarely more)

- Term length: 6 to 36 months

- Origination fees: 1% to 8% of the loan

- Prepayment penalties: Some lenders charge you if you pay off early

Watch out for payday lenders. They don’t check credit scores at all - but they charge $15 to $30 per $100 borrowed. That’s a 400% APR if you roll it over. These loans trap people in cycles of debt. They’re not loans - they’re financial quicksand.

What lenders look for besides your score

If your score is low, your other financial habits matter more. Lenders who work with bad credit borrowers focus on:

- Steady income: Do you get paid every two weeks? Do you have a job, gig work, or government benefits? Proof of income is key.

- Debt-to-income ratio: If you’re spending more than 50% of your income on debt payments, you’re unlikely to get approved.

- Recent positive activity: Did you pay off a collections account? Did you start making on-time payments on a secured credit card? Lenders notice.

- Collateral: Some lenders will lend to you if you put up something valuable - like a car title or savings account - as security.

One lender we spoke with said they approve 70% of applicants with scores under 500 if they have a bank account with 6 months of pay stubs and no new debt in the last year. The score is just the first filter.

How to improve your chances

Even if you have a 400 score, you can increase your odds:

- Check your credit report - Errors are common. A $200 medical bill in collections that’s not yours can tank your score. Get your free report at AnnualCreditReport.com.

- Pay down what you can - Even paying $50 toward a collection account can help. Some scoring models ignore paid collections.

- Apply for a secured loan - Put down $500 as collateral, and you might get approved for $500. Pay it off on time, and your score rises.

- Use a co-signer - Someone with good credit can help you qualify. But they’re on the hook if you default.

- Avoid multiple applications - Each hard inquiry drops your score by 5-10 points. Apply to one or two lenders at most.

Alternatives to bad credit loans

Before you take a high-cost loan, ask yourself: Is there another way?

- Credit union small-dollar loans: Many offer “payday alternative loans” (PALs) at 18% APR or less. You need to be a member, but membership is often free.

- Family or friends: A small loan with no interest can save you thousands in fees.

- Payment plans: Call your medical provider, utility company, or landlord. Many will let you pay in installments with no credit check.

- Community assistance programs: Local nonprofits and religious groups often help with emergency expenses.

These options don’t build credit like a loan does - but they don’t trap you in debt either.

What happens after you get the loan

Getting approved is just the start. The real goal is to get out of bad credit. Here’s how:

- Make every payment on time - even if it’s just the minimum.

- Ask your lender to report your payments to the credit bureaus. Not all do.

- After 6-12 months of on-time payments, your score should jump 50-100 points.

- Then, apply for a credit-builder loan or a secured credit card.

One borrower we followed improved from 420 to 610 in 10 months by paying $100 a month on a $1,000 secured loan. That’s the power of consistent, responsible borrowing.

Frequently Asked Questions

What is the lowest credit score to get a personal loan?

Some lenders approve personal loans for people with scores as low as 300, but these are rare and come with very high interest rates. Most subprime lenders require at least 450 to 500. The lower your score, the smaller the loan amount and the higher the cost.

Can I get a loan with a 400 credit score?

Yes, but only from specialized lenders like online subprime lenders or tribal lenders. You’ll likely get a small loan ($500-$2,000) with an APR over 35%. Make sure you can afford the payments - defaulting will make your credit worse.

Do payday lenders check credit scores?

Most payday lenders don’t check your credit score at all. They only require proof of income and a bank account. But their fees are extremely high - often the equivalent of 400% APR. These are not loans for building credit. They’re traps.

How long does it take to rebuild credit after a bad loan?

If you make all payments on time for 6 to 12 months, your score can improve by 50 to 100 points. The key is consistency. Paying off a loan early doesn’t hurt - it helps. Avoid new debt and keep using credit responsibly.

Is it better to get a loan with a co-signer or go it alone?

A co-signer can help you qualify for better rates and higher amounts. But if you miss payments, it hurts their credit too. Only use a co-signer if you’re absolutely sure you can repay the loan. Otherwise, a secured loan or credit-builder loan is safer.