What Is the Replacement Cost Price in Home Insurance?

Dec, 14 2025

Dec, 14 2025

Home Insurance Replacement Cost Calculator

Calculate Your Replacement Cost

Replacement Cost Estimate

Recommended Actions

- 1 Update coverage within 2 years

- 2 Get detailed rebuild estimate from licensed contractor

- 3 Consider extended coverage for inflation

When your home gets damaged by fire, storm, or other covered events, your home insurance doesn’t just pay you what your house is worth today. It pays to replace it. That’s where replacement cost price comes in-and it’s one of the most important numbers you need to know if you want to actually recover after a disaster.

What exactly is replacement cost price?

Replacement cost price is the amount it would cost to rebuild your home from the ground up, using the same materials and quality, at today’s prices. It doesn’t include the land value. It doesn’t factor in how old your house is. It doesn’t care if your kitchen is 20 years old. All it asks is: if this house burned down tomorrow, how much would it cost to build an exact copy?

This is different from market value. Your home might sell for $600,000 because it’s in a hot neighborhood. But if you had to rebuild it, the actual cost might be $450,000. That’s the number your insurance company needs to know.

Most standard home insurance policies in Canada and the U.S. offer replacement cost coverage-not actual cash value. That means if your 15-year-old roof gets destroyed, you won’t get paid for what it was worth after depreciation. You’ll get enough to buy and install a brand-new roof. That’s a big difference.

Why replacement cost matters more than you think

Here’s a real scenario: A family in Mississauga lost their home to a kitchen fire in 2024. Their policy said $300,000 in coverage. They assumed that was enough. But when they called contractors, they found out rebuilding the same 2,200-square-foot brick home with modern insulation, electrical codes, and finishes would cost $410,000. They were left with a $110,000 gap.

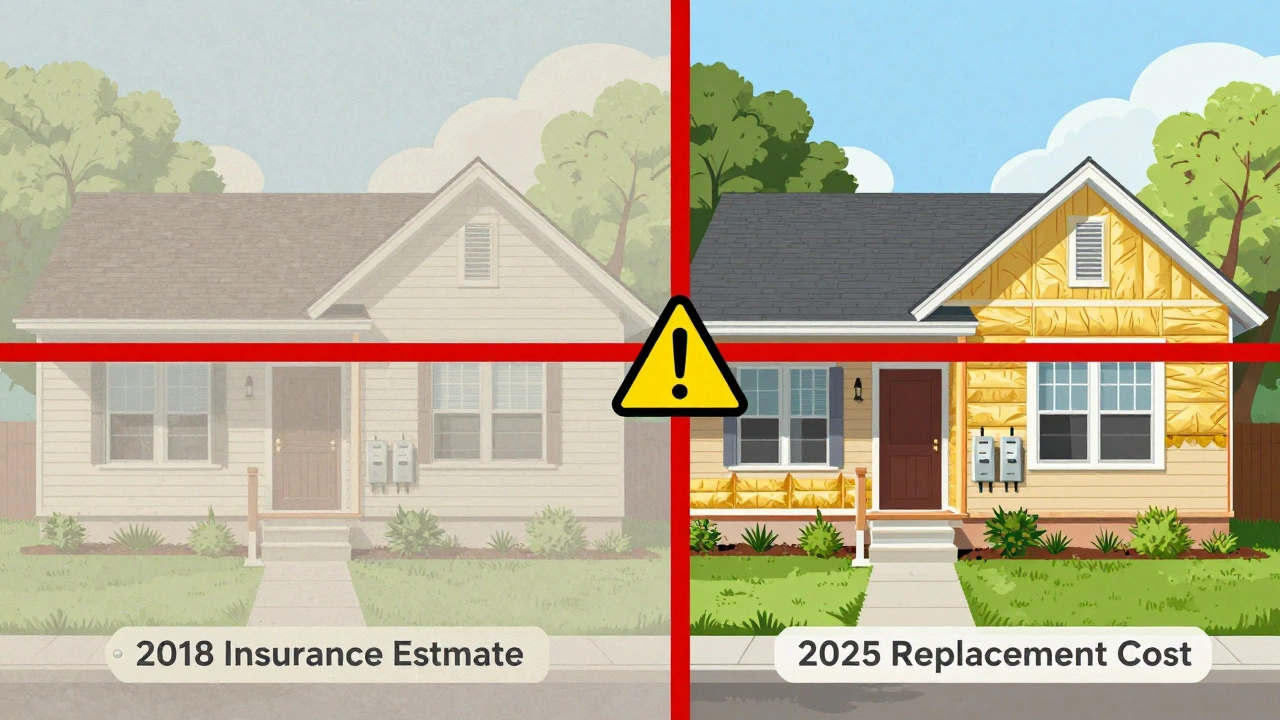

That’s not rare. Construction costs have jumped nearly 30% since 2020 because of labor shortages, material inflation, and stricter building codes. A study by the Canadian Home Builders’ Association in 2025 showed that the average cost to rebuild a detached home in Ontario rose from $225 per square foot in 2021 to $290 per square foot in 2025.

If your insurance coverage is based on an old estimate, you could be underinsured. And if you’re underinsured, you pay the difference out of pocket. That’s not just inconvenient-it can be devastating.

How is replacement cost calculated?

Insurance companies don’t guess. They use specialized software that takes into account:

- Size of your home (square footage)

- Construction type (brick, wood frame, stucco, etc.)

- Roof material and pitch

- Number of bathrooms and kitchens

- Quality of finishes (hardwood floors, custom cabinetry, high-end appliances)

- Location (urban vs. rural, access for trucks, local labor rates)

- Current building code requirements (like seismic or energy efficiency upgrades)

Some insurers do this automatically when you sign up. Others require you to request a replacement cost evaluation. If your policy hasn’t been reviewed in the last 2-3 years, it’s probably outdated.

Don’t rely on your property tax assessment. That’s based on land value and market trends, not construction costs. It’s useless for insurance purposes.

What happens if you’re underinsured?

If your coverage limit is lower than the actual replacement cost, the insurance company won’t pay the full amount to rebuild. They’ll only pay a proportion of your claim based on how much coverage you have compared to what you need.

Let’s say your home’s true replacement cost is $500,000, but your policy only covers $400,000. That’s 80% of what you need. If you file a $100,000 claim for fire damage, the insurer will only pay you $80,000. The other $20,000? You’re on your own.

This is called the coinsurance penalty. Most policies have a clause that says you must carry at least 80% of the replacement cost to avoid it. But even that 80% rule isn’t enough if your estimate is wrong.

How to make sure your replacement cost is accurate

You don’t need to be an expert. Here’s what to do:

- Request a replacement cost evaluation from your insurer. Most will do it for free.

- Get a second opinion from a licensed builder or appraiser. Ask for a detailed rebuild estimate.

- Update your policy every 2 years-or after any major renovation, addition, or upgrade.

- Don’t forget outbuildings: garages, sheds, fences, and decks are included in replacement cost calculations.

- Ask if your policy includes extended replacement cost coverage. Some insurers offer 25-50% extra if costs exceed your limit due to inflation or supply shortages.

One homeowner in Toronto added a 400-square-foot sunroom in 2023. She never told her insurer. When a hailstorm damaged her roof in 2025, her claim was denied for the sunroom because it wasn’t on the policy. That $75,000 addition was completely out of pocket.

Replacement cost vs. actual cash value: what’s the difference?

Some cheap policies offer actual cash value (ACV) instead. ACV pays you what your item was worth at the time of loss-minus depreciation.

Example: Your 10-year-old washing machine is destroyed. ACV might pay you $300. Replacement cost pays you $800 for a new one.

For personal belongings, ACV might save you a few dollars a year on premiums. But for your home’s structure? Never accept ACV. The difference in payout after a total loss can be hundreds of thousands of dollars.

What to do right now

Don’t wait for a disaster to find out you’re underinsured. Here’s your checklist:

- Log into your insurer’s portal and check your current replacement cost estimate.

- If you can’t find it, call your agent and ask for the latest rebuild cost.

- If your estimate is more than two years old, request a new one.

- Compare it to recent construction quotes in your area.

- If there’s a gap, increase your dwelling coverage immediately.

It’s not expensive to adjust your coverage. A $50,000 increase in dwelling coverage might only raise your premium by $100-$150 a year. That’s cheaper than paying $50,000 out of pocket after a fire.

Final thought

Your home is probably your biggest investment. Insurance isn’t about getting a good deal-it’s about making sure you can get back to where you started. Replacement cost price isn’t a number on a page. It’s your safety net. Get it right, and you sleep well. Get it wrong, and you could lose everything you built.

Is replacement cost the same as market value?

No. Market value is what your home would sell for on the open market, including land value and neighborhood demand. Replacement cost is only what it costs to rebuild the structure itself using current materials and labor. They’re often very different.

Do I need to update my replacement cost every year?

You don’t need to update it every year, but you should review it every 2-3 years. Construction costs rise steadily, and renovations or upgrades can significantly increase your rebuild cost. Major changes like adding a basement suite or expanding your garage should trigger an immediate update.

What if my insurer says my replacement cost is too high?

Insurers use software to estimate rebuild costs, but those tools aren’t perfect. If you have a custom home, older architectural details, or high-end finishes, their estimate may be too low. Ask for a detailed breakdown of their calculation. Then get a second opinion from a local contractor. You have the right to challenge their number with real quotes.

Does replacement cost cover code upgrades?

Standard policies usually don’t. But many insurers offer optional coverage called “ordinance or law” coverage. This pays for upgrades required by current building codes after a loss-like adding fire sprinklers or upgrading electrical panels. It’s worth adding if you live in an older neighborhood.

Can I just use an online calculator instead of talking to my insurer?

Online calculators can give you a rough idea, but they’re not reliable. They don’t account for local labor rates, unique materials, or recent code changes. Only your insurer’s official evaluation or a licensed contractor’s quote will give you accurate numbers for insurance purposes.