What Is Usually Covered in Home Insurance? A Clear Breakdown for Canadian Homeowners

Feb, 15 2026

Feb, 15 2026

Home Insurance Coverage Calculator

Determine Your Minimum Dwelling Coverage

Get an accurate estimate of your home's replacement cost based on current Canadian construction rates. Your policy should match this amount, not your home's market value.

Estimated Minimum Coverage Needed

Based on current construction costs in :

Replacement cost (not market value) - includes rebuilding costs for your home structure only.

Your actual coverage should match this amount. In Toronto, for example, a 2,000 sq ft home might cost $400,000 to rebuild today.

Why this matters

Many homeowners are underinsured because they base coverage on mortgage value or market price. Your policy should cover replacement cost - what it would cost to rebuild today.

Common pitfalls

If your home is destroyed and your coverage is based on original purchase price, you'll pay out of pocket for the difference. The article shows how $400,000 in dwelling coverage can be needed for a 2,000 sq ft home in Toronto.

When you buy home insurance, you’re not just paying for peace of mind-you’re buying protection against real, costly disasters. But what exactly does that protection include? Many people think home insurance covers everything, but that’s not true. Even in Canada, where home insurance is almost mandatory for homeowners with mortgages, there are big gaps in coverage if you don’t know what’s in your policy.

Structure of a Standard Home Insurance Policy

Most home insurance policies in Canada break down into five main parts: dwelling coverage, other structures, personal property, loss of use, and personal liability. These are the building blocks. If your policy doesn’t include all five, you’re missing key protection.

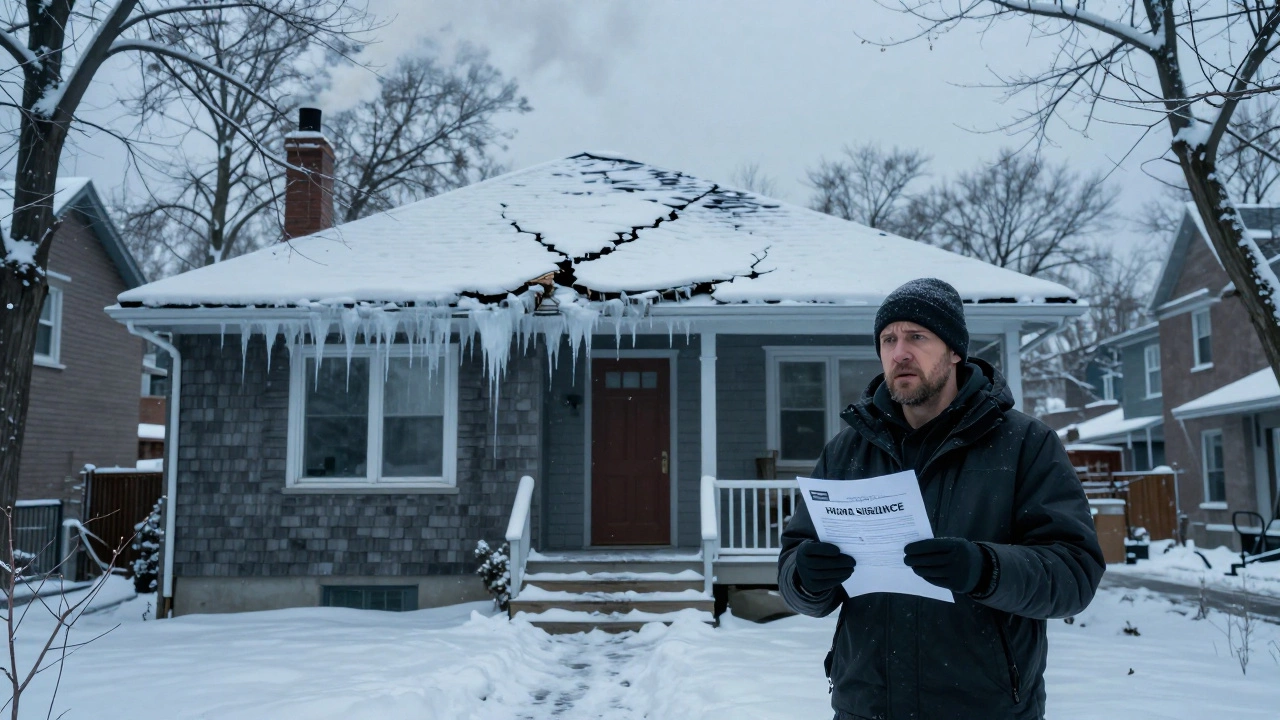

Dwelling coverage is the part that pays to repair or rebuild your home if it’s damaged by covered events like fire, windstorms, or hail. This doesn’t cover the land value-it’s only for the structure itself. In Toronto, where winter storms can tear off roofs or cause ice dams, this is critical. Most policies calculate this based on replacement cost, not market value. That means if your 2,000-square-foot house costs $400,000 to rebuild today, your coverage should match that, not what you paid for it in 2018.

Other structures covers detached buildings on your property, like sheds, garages, or fences. This is usually 10% of your dwelling coverage. So if your house is insured for $400,000, you get $40,000 for these structures. That sounds like a lot-until a tree falls on your detached garage during a storm and the repair bill hits $35,000. Then you realize you’re barely covered.

Personal property protects your belongings-furniture, clothes, electronics, appliances. This is typically 50% to 70% of your dwelling coverage. So if your home is insured for $400,000, you might have $200,000 to $280,000 for your stuff. But here’s the catch: most policies use actual cash value (ACV), not replacement cost. That means if your 5-year-old TV is stolen, you get what it’s worth today-maybe $200-not the $800 you paid for it new. Upgrading to replacement cost coverage adds about 10% to your premium but saves you thousands if disaster strikes.

Loss of use pays for temporary housing if your home becomes unlivable. If a fire forces you out for three months, this covers hotel stays, meals, even pet boarding. It’s usually 20% of your dwelling coverage. So for a $400,000 home, you’d get $80,000. That sounds generous-until you realize luxury hotels in downtown Toronto cost $500 a night. You could burn through your entire loss of use benefit in just 160 days.

Personal liability covers legal costs and medical bills if someone gets hurt on your property. This is often $1 million to $2 million. If your kid throws a ball and breaks a neighbor’s window, or a guest slips on your icy walkway and breaks a hip, this part kicks in. It also covers libel or slander claims. Most people don’t realize this extends beyond your property-like if you accidentally damage someone’s car while walking your dog.

What’s Typically Not Covered

Knowing what’s covered is only half the battle. The other half is knowing what’s left out. Here are the most common exclusions:

- Flood damage-Even in flood-prone areas like Hamilton or Abbotsford, standard policies don’t cover water entering from outside. You need separate flood insurance, which became widely available in Canada after 2020.

- Earthquakes-Not covered in Ontario, but essential if you live near the Cascadia subduction zone in British Columbia. Earthquake coverage is sold as an add-on, and premiums vary wildly.

- Wear and tear-If your roof leaks because it’s 25 years old and never replaced, that’s on you. Insurance doesn’t cover maintenance neglect.

- Home-based businesses-If you run a daycare, Etsy shop, or consulting business from home, your personal property coverage for business equipment is usually capped at $2,500. You need a business endorsement.

- Sewer backup-This is a growing problem in older cities like Montreal and Winnipeg. Many policies exclude it unless you add a specific rider. In 2024, sewer backup claims rose 37% in Ontario alone.

High-Value Items Need Special Coverage

Standard personal property coverage has limits per category. For example, jewelry might be capped at $1,500 total, and electronics at $5,000. If you own a $10,000 engagement ring or a $7,000 home studio setup, you’re underinsured.

That’s where scheduled personal property comes in. You list each high-value item, get it appraised, and pay a small extra premium. In return, you get replacement cost coverage with no deductible. This is especially important in cities like Vancouver or Toronto, where theft rates are rising. One Toronto homeowner lost a collection of rare watches worth $22,000 in a 2023 break-in. Because they weren’t scheduled, they got $1,500. They now have a separate rider for every piece.

How to Know What’s in Your Policy

Don’t assume your policy is right just because your insurer says so. Here’s how to check:

- Find your Declarations Page (Dec Page). This is the one-page summary your insurer sends after you buy or renew. It lists all coverages, limits, and deductibles.

- Look for the word “exclusions.” It’s usually in bold or a separate section. Read it. If it says “flood,” “earthquake,” or “sewer backup,” you’re not covered unless you added it.

- Check the replacement cost estimate. Is it based on current construction costs in your neighborhood? If your house is in a historic Toronto neighborhood, rebuilding costs can be 40% higher than average due to heritage materials.

- Review your personal property limits. Do you have more than $5,000 in electronics? More than $2,000 in jewelry? If yes, you need an upgrade.

Most people don’t update their policy after buying new furniture, upgrading their kitchen, or having a baby (who then accumulates toys, electronics, and gear). Your policy should be reviewed every 1-2 years-not just when your renewal notice arrives.

Real-World Scenarios That Prove Coverage Matters

In 2024, a home in Mississauga caught fire from an overloaded outlet. The fire destroyed the kitchen and living room. The homeowner had $500,000 dwelling coverage, $250,000 personal property, and $1 million liability. They got everything replaced-because they’d upgraded to replacement cost and added sewer backup coverage after a basement flood two years earlier.

Compare that to a family in Ottawa whose basement flooded after a pipe burst. They had standard coverage. The insurer paid $1,200 for water damage because “burst pipes” were covered, but not the $8,000 in ruined hardwood flooring because it was labeled “water damage from within”-a gray area. They had to pay out of pocket.

These aren’t rare cases. In 2025, the Insurance Bureau of Canada reported that 42% of homeowners didn’t know whether their policy covered sewer backup. Nearly 30% had never reviewed their personal property limits.

What to Do Next

Don’t wait for disaster to find you. Take five minutes today:

- Find your latest insurance declaration page.

- Check your dwelling coverage amount. Is it based on current rebuild costs? If not, call your agent.

- Review personal property limits. If you’ve bought new electronics, furniture, or jewelry since 2023, you’re likely underinsured.

- Ask if you have flood, sewer backup, or earthquake coverage. If not, ask how much it costs to add.

- Consider scheduling high-value items. A $200 annual premium for a $15,000 jewelry collection is a bargain.

Home insurance isn’t about getting the cheapest rate. It’s about having the right coverage when you need it most. In Canada, where weather extremes and aging infrastructure are becoming the norm, knowing what’s covered isn’t optional-it’s essential.

Does home insurance cover water damage from a leaky roof?

Yes-if the leak is caused by a sudden, accidental event like a storm-damaged shingle or a fallen tree. But if the leak happened because you ignored worn shingles for years, it’s considered maintenance neglect and won’t be covered. Insurance pays for sudden damage, not gradual wear.

Is personal property coverage enough for expensive electronics?

Usually not. Most policies cap electronics at $5,000 total, and often pay only actual cash value-not replacement cost. If you own a $4,000 home theater system or a $3,000 laptop setup, you’ll likely be underinsured. Schedule these items separately for full replacement coverage.

Do I need flood insurance if I live in a low-risk area?

Yes. In Canada, floods are the most common and costly natural disaster-not fires or storms. Even homes on hills have been flooded due to burst pipes, sewer backups, or heavy rainfall overwhelming drainage systems. Standard policies don’t cover it. Flood insurance is affordable and available through most insurers.

What happens if I don’t update my home insurance after renovating?

You risk being underinsured. If you spent $50,000 on a kitchen upgrade and never told your insurer, you might only get $10,000 back if the kitchen burns down. That’s because your dwelling coverage is based on the original rebuild cost. Always notify your insurer after major renovations.

Can I get home insurance if I rent out part of my house?

Yes, but standard home insurance won’t cover it. You need a landlord policy or a tenant endorsement. If you rent out a basement suite, your liability coverage may be void if a tenant is injured. Most insurers require you to disclose rental activity upfront.