When Should You Not Finance a Car? 7 Clear Signs to Walk Away

Dec, 1 2025

Dec, 1 2025

Car Payment Affordability Calculator

Check Your Car Payment Affordability

Enter your information to see if your car payment fits within the recommended 15% of your take-home pay.

Financing a car feels like the default move. Everyone does it. Dealers push it. Ads make it look easy. But just because you can finance a car doesn’t mean you should. Too many people end up trapped in payments they can’t afford, driving a car that loses value faster than they pay it off, and drowning in debt they never planned for.

You’re Putting Down Less Than 20%

Putting down a small down payment - say $1,000 or even nothing at all - is a recipe for trouble. Cars depreciate fast. A new car can lose 20% of its value in the first year. If you finance 100% of the price, you start off owing more than the car is worth. That’s called being upside down on your loan.Here’s what that looks like in real life: You buy a $35,000 SUV with zero down and a 72-month loan at 7% interest. After 12 months, you’ve paid about $5,000, but the car is now worth $27,000. You still owe $31,000. If you get into an accident, get towed, or need to sell, you’re stuck paying thousands out of pocket just to walk away.

Experts recommend at least 20% down. That buffer keeps you from sinking into negative equity. If you can’t afford 20%, wait. Save more. A used car with a bigger down payment beats a new car with zero down every time.

Your Monthly Payment Is More Than 15% of Your Take-Home Pay

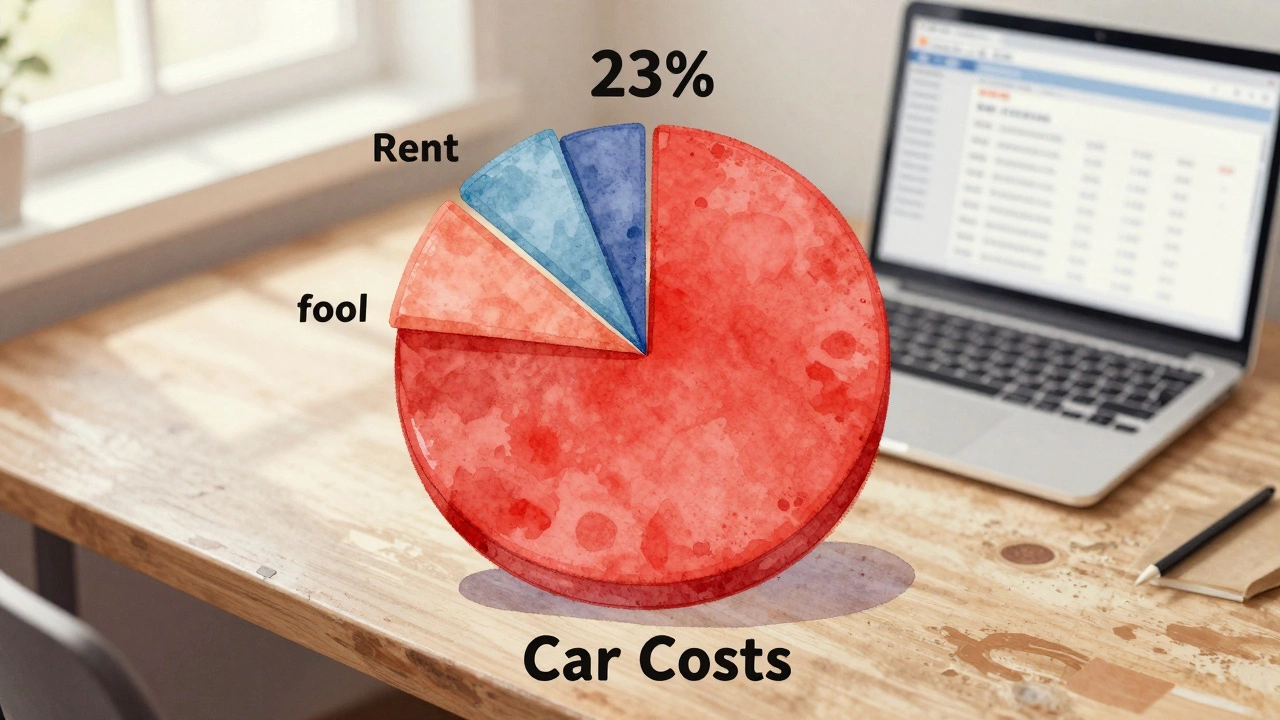

A car payment shouldn’t eat your budget alive. A good rule of thumb: your total monthly transportation costs - that’s payment, insurance, gas, maintenance - should not exceed 15% of your take-home pay.Let’s say you earn $4,000 a month after taxes. Your car payment is $600. That’s 15%. Sounds okay, right? But add $150 for insurance, $100 for gas, and $80 for oil changes and tires? Now you’re spending $930 a month on your car. That’s 23% of your income. You’re not saving. You’re not building an emergency fund. You’re just keeping the wheels turning.

If your payment pushes you past 15%, it’s a red flag. You’re choosing a lifestyle you can’t sustain. Walk away. Look for a cheaper car. Or delay the purchase until your income grows or your expenses shrink.

You’re Financing for More Than 60 Months

Longer loans look attractive because the monthly payment is lower. But they’re a trap. A 72-month or 84-month loan means you’re paying interest for way longer than the car will last. And you’re locked in.Most cars start needing major repairs after 7 years. If you’re on an 84-month loan, you’re still paying off a car that’s already falling apart. You’re not building equity - you’re just handing money to the bank while your transmission fails.

Stick to 60 months or less. If you can’t afford a 60-month payment on the car you want, you can’t afford the car. Period. A longer loan doesn’t make it affordable - it just makes the pain last longer.

You’re Buying a New Car When a Reliable Used One Will Do

New cars cost more. Insurance is higher. Depreciation is brutal. A three-year-old car with 30,000 miles on it often has the same reliability as a brand-new model - but costs 30% less.For example, a 2022 Honda Civic with 25,000 miles might sell for $19,000. The 2025 model? $27,000. That’s $8,000 you could save. That’s a full year’s worth of gas, insurance, and maintenance. You could put that $8,000 into a high-yield savings account and earn interest while you drive.

Used cars from 2020-2023 are full of reliable options. Look for certified pre-owned programs from manufacturers. They come with extended warranties and have been inspected. You get nearly new reliability without the new-car price tag.

You Have High-Interest Debt Already

If you’re carrying credit card debt at 20% APR, student loans at 7%, or personal loans with double-digit rates, adding a car loan is a financial mistake.Car loans usually have lower interest than credit cards - but that doesn’t mean they’re safe. When you’re already drowning in debt, taking on more is like pouring water into a sinking boat. Your credit score is likely already strained. Your debt-to-income ratio is probably too high. Lenders might approve you, but that doesn’t mean you should accept.

Focus on paying down high-interest debt first. Once you’ve cleared that, you’ll qualify for better car loan rates - and you’ll have more breathing room in your budget. A car loan isn’t an emergency. Credit card debt is.

You’re Financing Just to Keep Up

This one is quiet but dangerous. You don’t need a new truck because you haul stuff. You don’t need a luxury SUV because your neighbor has one. You’re doing it because you feel like you’re falling behind.Car companies and ads want you to believe your vehicle defines your worth. That’s not true. A reliable, paid-off 2018 Toyota Corolla doesn’t make you less successful than someone driving a $50,000 BMW with a $900 monthly payment.

Ask yourself: Am I buying this car because I need it - or because I’m afraid of what people will think? If it’s the latter, walk away. Financial freedom isn’t about appearances. It’s about having options. And options come from not being tied to a payment.

Your Job Is Unstable

If you’re in a gig economy job, work on contract, or your industry is shrinking, financing a car is risky. Car payments don’t pause when your income drops. Insurance and gas don’t disappear.Think about it: In 2023, over 40% of Canadians reported living paycheck to paycheck. If you lose your job for even a month, can you cover your car payment, insurance, and gas? If the answer is no - or even maybe - don’t finance.

Buy a used car with cash. Or delay the purchase. Build a 3-6 month emergency fund first. That safety net gives you power. Without it, a single missed paycheck could mean repossession.

What to Do Instead

If any of these signs apply to you, you’re better off waiting. Here’s what to do instead:- Save for a larger down payment - aim for 20% or more

- Delay your purchase until your debt-to-income ratio improves

- Buy a reliable used car with cash or a short-term loan

- Use public transit, biking, or carpooling while you save

- Build an emergency fund before you buy anything big

There’s no shame in waiting. The people who buy cars without thinking are the ones who end up regretting it. The people who wait - they’re the ones who drive paid-off cars for years, with no payments, no stress, and real financial freedom.

Is it ever okay to finance a car with no down payment?

Only if you have a very high income, zero other debt, and plan to pay off the loan in under 48 months. For most people, zero down means you’re setting yourself up for negative equity. It’s a gamble you don’t need to take.

Can I finance a car if I have bad credit?

You might be approved, but the interest rate will be very high - often over 15%. That means you’ll pay thousands more over the life of the loan. Instead of financing, focus on improving your credit score for six months. Pay down balances, check your credit report for errors, and avoid new debt. Then come back.

Should I finance through the dealership or a bank?

Always get pre-approved by a bank or credit union first. Dealerships often mark up interest rates to earn commission. A bank loan gives you leverage to negotiate the car price without being pressured into their financing package. Credit unions often offer the lowest rates.

What’s the best age for a used car to buy?

Cars between two and five years old usually offer the best value. They’ve already taken their biggest depreciation hit, but still have modern safety features and are likely under factory warranty. Avoid cars older than eight years unless they’ve been exceptionally well-maintained and come with a strong service history.

How do I know if I’m getting a good car loan rate?

As of late 2025, the average rate for a 60-month new car loan is around 6.5% for borrowers with excellent credit (750+). If you’re offered more than 8% with good credit, shop around. Rates below 5% are excellent. Anything above 10% is expensive - and a sign you should delay the purchase or improve your credit first.

Final Thought: The Real Cost of a Car

A car isn’t just the sticker price. It’s insurance, gas, maintenance, parking, and the interest you pay over five years. Most people forget the last one. But that interest? It’s money you’ll never get back.The smartest car you can buy is the one you pay for in full - and drive for as long as it runs. You don’t need to impress anyone. You just need to be free.