How Many People Have $300K in Savings? Real Numbers Behind the Goal

Feb, 16 2026

Feb, 16 2026

Savings Goal Calculator

Your Savings Plan

Canadian Savings Context

Statistics Canada shows that 58% of Canadian households have less than $10,000 in liquid savings. Only 12% have over $100,000.

What this means for you: If you reach $300K, you'll be in the top 5% of Canadian savers.

Your Results

Enter your savings details to see your timeline.

How many people actually have $300,000 saved up? It sounds like a big number - maybe even unreachable. You hear it in podcasts, see it in financial blogs, and maybe even set it as your own target. But here’s the truth: most people don’t come close. And that’s not because they’re lazy or bad with money. It’s because saving $300K isn’t just about discipline - it’s about income, time, and life circumstances.

Canada’s Real Savings Picture

In Canada, the median household net worth is around $400,000. But that number includes homes, investments, and pensions - not just cash in savings accounts. When you strip out home equity and retirement accounts, the amount of liquid savings most Canadians hold is far lower.

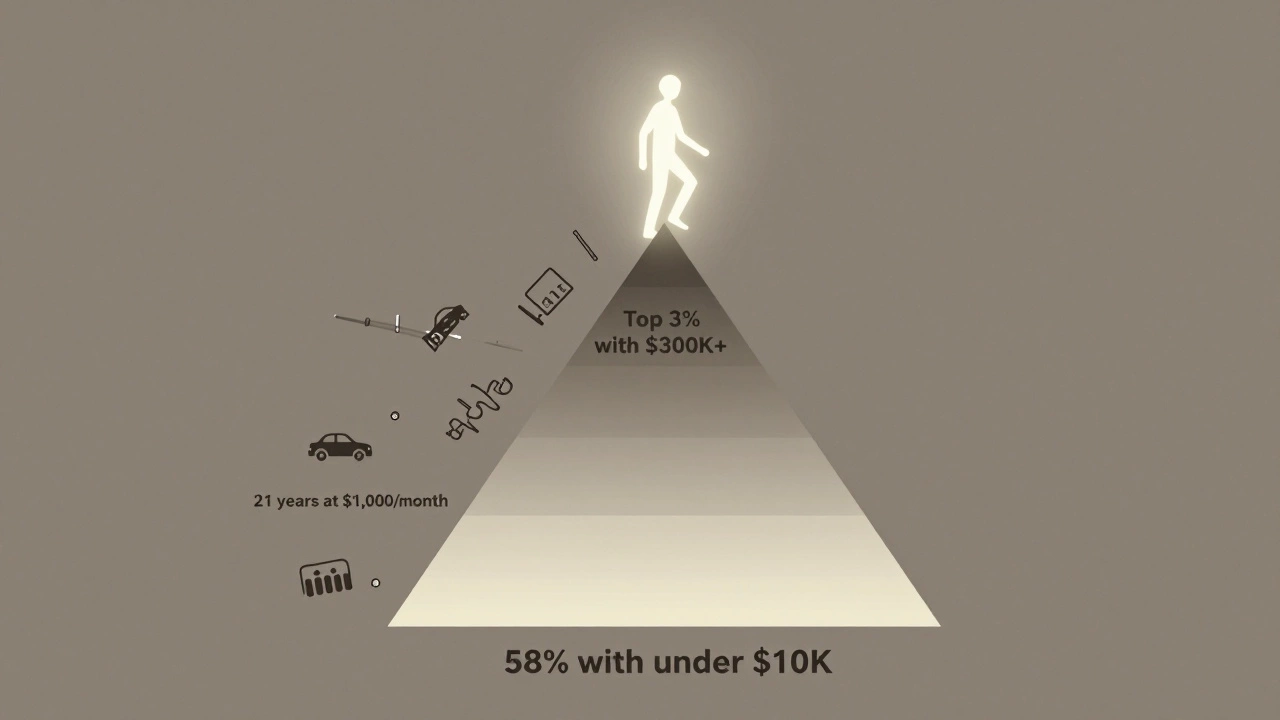

A 2024 report from Statistics Canada found that 58% of working-age households (ages 25-64) have less than $10,000 in liquid savings. Only 12% have more than $100,000. That means if you’re aiming for $300,000 in savings, you’re already in the top 5% of savers - maybe even the top 3%.

Let’s break that down further. Among Canadians aged 55 and older - the group closest to retirement - only 1 in 4 have more than $250,000 in total retirement assets (RRSPs, TFSAs, pensions). That includes locked-in funds you can’t touch until retirement. If you’re asking about accessible savings - cash in chequing or savings accounts - the number drops even lower.

Why $300K Feels Impossible

Let’s say you’re 30, earning $65,000 a year after tax. You save $1,000 a month. That’s $12,000 a year. At that rate, it takes 25 years to hit $300,000 - and that’s without any interest. If you earn 4% annually on your savings (a realistic return for a high-interest savings account or GICs), you’d reach $300K in about 21 years. That puts you at 51.

But here’s what most people don’t account for: inflation, unexpected costs, and life changes. A car breaks down. A parent needs help. A job loss hits. A medical bill shows up. In Canada, the average out-of-pocket healthcare cost per household is over $1,800 a year - and that’s just for things insurance doesn’t cover.

And let’s not forget housing. In Toronto, a $700,000 home might cost $4,000 a month to carry - mortgage, property tax, insurance, maintenance. That eats up half a middle-income salary. If you’re spending $2,500 a month on rent or mortgage, $800 on groceries, $400 on utilities, and $600 on transportation, you’ve got $1,700 left. That’s not much room to save $1,000 a month.

Who Actually Hits $300K?

There are three groups who typically reach this milestone:

- High-income earners - people making $120K+ annually with low expenses. They save 25-30% of income consistently.

- Early savers - those who started in their 20s, lived frugally, and let compound interest do the heavy lifting.

- Homeowners with equity - people who paid off their homes early and redirected those payments into savings or investments.

Most people in the middle - earning $50K-$90K, with kids, car payments, and student debt - rarely get there without a major windfall, inheritance, or a side business.

It’s Not Just About Cash

Many people confuse total net worth with liquid savings. If you have $300K in your RRSP, $150K in home equity, and $50K in a TFSA, you’re sitting on $500K. But if you can’t access $300K in cash without penalties or selling assets, it doesn’t help when your furnace dies or you lose your job.

Real savings means money you can touch, move, or spend without consequences. That’s why the $300K goal matters - not because it’s magic, but because it represents a safety net. It’s enough to cover 2-3 years of living expenses if you’re unemployed. It’s enough to pay for long-term care, a major medical procedure, or a career change.

What Should You Aim For Instead?

If $300K feels out of reach, here’s a better approach:

- Start with $10K - that’s your emergency fund. Enough to cover 3-6 months of essentials.

- Then hit $50K - now you can handle major repairs, medical bills, or a job gap without panic.

- Then $100K - you’ve built real financial breathing room. You can afford to take risks - like switching careers or starting a business.

- $300K? That’s the next level. It’s not a failure if you don’t get there. It’s a luxury most people never reach.

Focus on progress, not perfection. A 25-year-old who saves $500/month will have $250K by 55 - even with modest returns. That’s not nothing. That’s security.

What’s Holding You Back?

It’s rarely about how much you earn. It’s about:

- Not having a written savings plan

- Letting lifestyle inflation creep in

- Waiting for the "right time" to start

- Not automating your savings

- Confusing saving with investing

Automating $300 a month into a TFSA or high-interest savings account is the easiest way to build momentum. You won’t feel it. But in 10 years, you’ll have $40,000 - and that’s a foundation.

Final Thought: It’s Not About the Number

The number $300,000 is arbitrary. Some people need $500K to feel secure. Others are fine with $150K. What matters isn’t the target - it’s the habit. The discipline. The understanding that saving isn’t about being rich. It’s about being free.

If you’re reading this and thinking, "I’ll never get there," you’re wrong. You don’t need $300K to be okay. But you do need to start somewhere. And the best time to start? Yesterday. The second best? Today.

Is $300K in savings realistic for the average Canadian?

For most Canadians, $300K in liquid savings is not realistic. Statistics Canada data shows that 58% of households have less than $10,000 in savings. Only about 12% have over $100,000. Reaching $300K typically requires high income, early start, or significant life advantages like homeownership or inheritance.

What’s the difference between savings and retirement savings?

Savings are accessible cash - like money in a TFSA or high-interest account. Retirement savings are locked-in funds like RRSPs, pensions, or LIRAs that you can’t touch until retirement age. Many people confuse the two. You might have $300K in your RRSP, but if you can’t access it before 55, it doesn’t help with emergencies or job loss.

Can I reach $300K if I make $60,000 a year?

Yes, but it takes time and discipline. Saving $1,000 a month ($12,000/year) at 4% interest will get you to $300K in about 21 years. That means starting at age 30, you’d reach it at 51. Most people making $60K struggle to save that much due to housing, childcare, and debt costs. It’s possible, but not common.

Should I focus on saving $300K or paying off debt first?

Pay off high-interest debt first - especially credit cards or personal loans with rates above 7%. Once you’re debt-free, you can redirect that monthly payment into savings. A balanced approach: build a $5K emergency fund, then attack debt, then rebuild savings. You can’t out-save high-interest debt.

Is investing better than saving for reaching $300K?

Yes, if you have time. Saving in a high-interest account will take decades. Investing in a diversified portfolio (like ETFs) with 6-8% average returns can cut that time in half. But investing carries risk. Start with savings for emergencies, then invest the rest. Don’t invest money you might need in the next 5 years.