What Is the US Equivalent of the ISA Account?

Nov, 27 2025

Nov, 27 2025

US Tax-Free Savings Calculator

This calculator helps you understand how US retirement accounts compare to the UK ISA for tax-free growth. The calculator uses a 7% annual return assumption as mentioned in the article.

Enter your values above to see potential tax-free growth

If you're from the UK and you've ever used an ISA - Individual Savings Account - you know how powerful it is. You put money in, it grows tax-free, and you never pay tax on the interest, dividends, or capital gains. It’s simple, flexible, and built into the way people save and invest. But if you move to the US or just want to understand how Americans handle the same thing, you’ll quickly realize: there’s no direct copy of the ISA in the United States. There’s no single account that does everything an ISA does. But there are tools that, when used together, get you close.

Why the ISA Is So Popular in the UK

The UK ISA lets you invest up to £20,000 per year (as of 2025) into cash, stocks, bonds, or even peer-to-peer loans - all tax-free. No capital gains tax. No income tax on dividends. No tax when you withdraw. You can hold it in a bank, a brokerage, or a robo-advisor. You can switch providers. You can split your allowance between cash and stocks. It’s designed to be simple and accessible, even for people who aren’t finance experts.

That’s why people ask: what’s the American version? The answer isn’t one account. It’s a combination of accounts, each with different rules, limits, and tax benefits. You have to stack them to get the same effect.

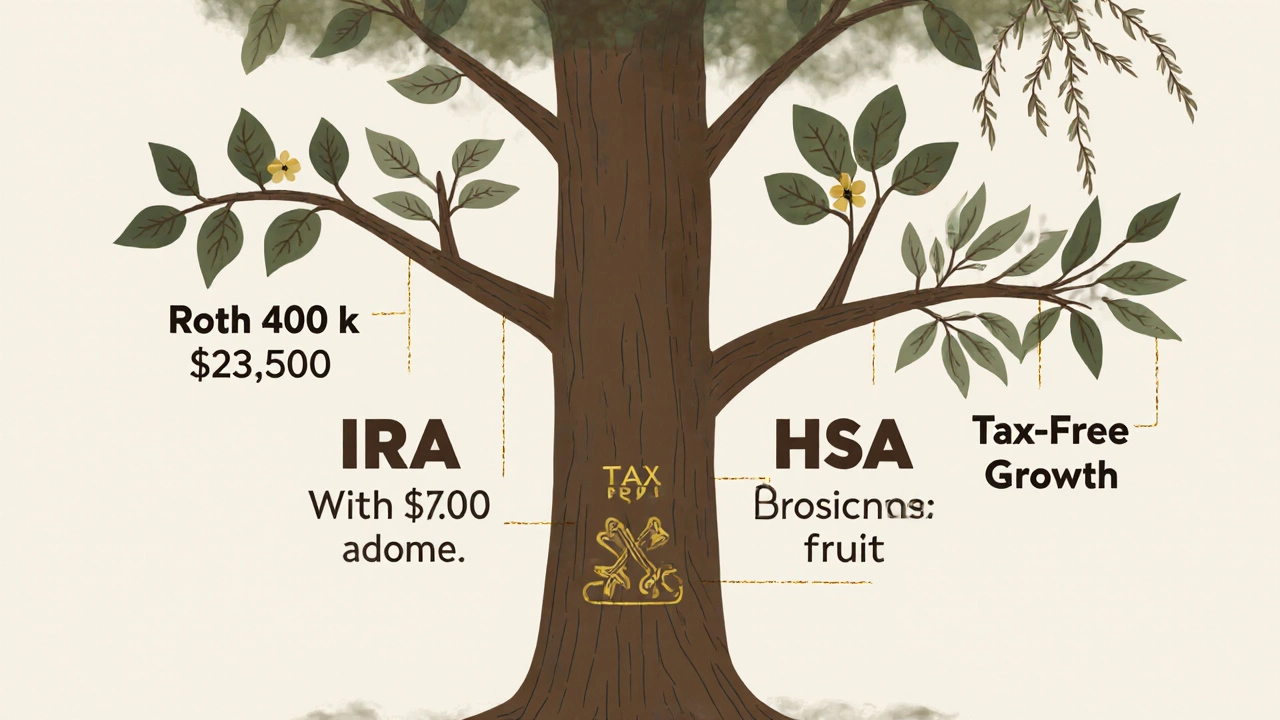

The Closest US Equivalent: The Roth IRA

The Roth IRA is the single best match for the ISA in terms of tax treatment. You contribute after-tax money - meaning you pay income tax upfront - and then everything inside grows tax-free. When you withdraw in retirement, you pay zero tax on the earnings, as long as you’re over 59½ and the account has been open for at least five years.

For 2025, you can contribute up to $7,000 per year to a Roth IRA ($8,000 if you’re 50 or older). That’s less than the UK’s £20,000 allowance, but the tax-free growth works the same way. If you invest $7,000 a year for 30 years and earn 7% annually, you’ll end up with over $700,000 - and every dollar of that growth is yours to keep, tax-free.

Here’s the catch: Roth IRAs have income limits. If you earn more than $161,000 as a single filer or $240,000 as a married couple filing jointly in 2025, you can’t contribute directly. You can still use a backdoor Roth IRA, but that adds complexity. The ISA has no income cap.

Another Big Player: The 401(k) with Roth Option

If you work for a company that offers a 401(k), you likely have access to a Roth 401(k). This works just like a Roth IRA but with much higher limits. In 2025, you can contribute up to $23,500 - or $31,000 if you’re 50 or older. That’s way closer to the UK ISA allowance.

The big advantage? No income limits. Anyone can contribute, no matter how much they earn. And many employers match contributions - which is free money you don’t get with an ISA.

The downside? You can’t access the money before retirement without penalties. Unlike an ISA, where you can pull cash out anytime, Roth 401(k) withdrawals before 59½ usually come with a 10% penalty unless you meet specific exceptions. That makes it less flexible than an ISA for short-term goals like buying a car or paying for a wedding.

What About Tax-Free Savings Accounts (TFSAs)?

Some people think Canada’s TFSA is the US equivalent. It’s not. The TFSA is Canadian. The US doesn’t have one. But it’s worth mentioning because the TFSA works almost exactly like the UK ISA - same tax-free growth, same flexible withdrawals, same contribution limits. If you’re comparing countries, the TFSA is the closest thing to the ISA. But in the US? You’re on your own.

Health Savings Accounts (HSAs): The Hidden Gem

HSAs are often overlooked, but they’re the only US account with triple tax advantages: you contribute pre-tax, the money grows tax-free, and you withdraw it tax-free for qualified medical expenses. That’s better than an ISA - which only gives you one layer of tax relief.

For 2025, you can contribute up to $4,300 if you’re single or $8,550 if you’re a family. That’s not as high as the ISA, but if you’re healthy and don’t spend much on medical care, you can let the money grow for decades. After age 65, you can withdraw it for any reason without penalty - though you’ll pay income tax on non-medical withdrawals.

Many people use HSAs as stealth retirement accounts. They’re not perfect, but they’re one of the most powerful tools in the US for tax-free growth - if you qualify.

Brokerage Accounts: The Non-Tax-Free Option

Most Americans use regular brokerage accounts to invest. These are the accounts you open with Fidelity, Vanguard, or Robinhood. The problem? They’re not tax-free.

You pay capital gains tax when you sell investments for a profit. You pay dividend tax every year, even if you reinvest. If you hold a stock for less than a year, you pay your full income tax rate on gains. If you hold it longer, you pay a lower rate - but you still pay.

That’s the opposite of an ISA. But here’s the thing: if you max out your Roth IRA and Roth 401(k), and you’ve used your HSA, a brokerage account is where you put the rest. It’s not tax-free, but it’s flexible. You can take money out anytime. No penalties. No age restrictions.

Putting It All Together: The US ISA Stack

There’s no single US account that equals the UK ISA. But if you combine these accounts, you get something just as powerful - maybe even better:

- First, max out your Roth 401(k) - up to $23,500 (or $31,000 if you’re 50+). If your employer matches, get that free money first.

- Then, fund your Roth IRA - up to $7,000. Use this for more control over your investments.

- If you have a high-deductible health plan, open a HSA - up to $8,550 for families. Use it for medical costs now or let it grow for retirement.

- Any extra money? Put it in a brokerage account. You’ll pay taxes, but you’ll have full access.

Together, these accounts can let you save and invest over $40,000 a year with significant tax advantages. That’s more than the UK ISA limit. And if you’re disciplined, you can build a portfolio that’s just as - or even more - tax-efficient than an ISA.

What You Can’t Do in the US That You Can in the UK

The ISA is a single account with one easy limit. The US system is fragmented. You need to know which account does what. You need to track multiple limits. You need to understand income rules, withdrawal penalties, and eligibility.

Also, the UK ISA lets you hold cash, stocks, bonds, and even peer-to-peer loans in one place. In the US, you can’t hold peer-to-peer loans in a Roth IRA easily. You can’t hold cash in a Roth IRA and earn meaningful interest - most providers pay less than 1%. You can’t switch between account types as easily.

And while the UK government gives you a clear annual allowance, the US system feels like a maze. One account has income limits. Another has contribution limits. Another has age restrictions. It’s not user-friendly.

Bottom Line: No Direct Copy, But You Can Still Win

If you’re used to the ISA, the US system will feel clunky. But it’s not worse - it’s just different. You don’t get one simple box. You get four powerful tools that, when used right, give you more control, more room to save, and more tax advantages.

Focus on the Roth 401(k) first. Then the Roth IRA. Then the HSA. Then the brokerage account. Build your stack. Don’t look for a single replacement. Look for a system.

The ISA is elegant. The US system is messy. But if you’re willing to learn how it works, you can end up with more tax-free growth than you ever could with a single ISA account.